Date: July 26, 2019

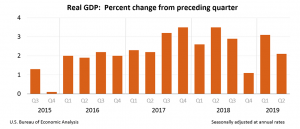

Real gross domestic product (GDP) grew for the second quarter of 2019 at an annual rate of 2.1%, based on the “advance” estimate released by the Bureau of Economic Analysis (BEA). The first quarter of 2019 real GDP yielded an increase of 3.1%.

According to BEA, the first estimate, released today, is based on incomplete source data that is subject to further revision by the source agency. The “second” estimate for the second quarter, based on more complete data, will be released on August 29, 2019.

For the second quarter, the increase in real GDP showcased positive contributions from personal consumption expenditures (PCE), federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, non-residential fixed investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The Bureau of Economic Analysis noted, “the deceleration in real GDP growth in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.”

A 2.2% increase was observed for the price index for gross domestic purchases, compared with an increase of 0.8% in the first quarter. The PCE price index climbed 2.3%, relative to an increase of 0.4%. Excluding food and energy prices, the PCE price index rose 1.8%, compared with an increase of 1.1%.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.