Sagicor Real Estate X Fund Limited (XFUND)

For the First Quarter ended June 30, 2017

Total Revenue for the six months grew 4% to $5.95 billion (2016: $5.70 billion). According to the company the increase in revenue for the period was due to “Improved hotel revenue, as tourist arrivals and room rates have improve over 2016”. For the quarter the company’s total revenue however declined 1% to close at 2.79 billion (2016: $2.83 million).

Hotel revenue for the six months period increased to $5.54 billion relative to $4.94 billion in 2016. Investment income and net capital gains on financial assets and liabilities decline to close at $14.95 million (2016: $27.77 million) and $432.32 million (2016: $728.34 million) respectively. Additionally, net investment property expense for the period ended June 2017 amounted to $31.65 million relative to nil in 2016.

Operating Expenses rose 14% to $4.91 billion (2016: $4.30 billion), this was attributed to a 12% increase in Hotel Expenses and a 19% increase in Interest Expense. The company indicated that the increase in interest expense was due to “Borrowings to finance the purchase of additional units in the Sigma Portfolio and a 15% investment in real property at the Jewel Grande Montego Bay (formerly known as Palmyra); and taxation of the earnings from these new investments”. Hotel expenses totaled $3.86 billion compared to $3.44 billion in 2016, while depreciation for the quarter totaled $307.83 million (2016: $236.03 million). Admin and other operating expenses fell 11% to close the quarter at $12.67 million relative to $14.18 million for the comparable period in 2016.

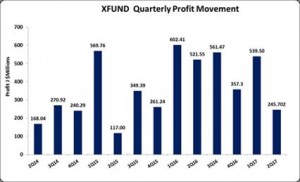

Consequently, Profit before Tax declined 25% to $1.04 billion (2016: $1.40 billion) for the six months. Following tax charges of $256.33 million (2016: $272.57 million), Net Profit reduced 30% to $785.20 million, down from $1.12 billion for the comparable period in 2016. For the second quarter Net Profit declined 53% to close at $245.70 million (2016: $521.55 million).

The earnings per share (EPS) for the six months closed at $0.35 (2016: $0.50), while the trailing twelve month EPS is $0.76. The number of shares used in our calculations was 2,243,005,125.

Balance Sheet Highlights:

The company, as at June 30, 2017, recorded total assets of $45.23 billion, an increase of 12% when compared to $40.28 billion recorded in the prior year.

Total Stockholders’ equity as at June 30, 2017 closed at $20.69 billion, a 24% increase from the $16.72 billion for the corresponding period last year. This resulted in a book value of $9.23 (2016: $7.45). A total of 2,243,005,125 shares were used in the calculation.