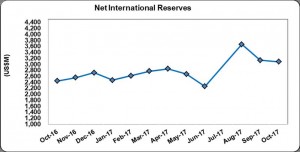

Jamaica’s Net International Reserves totaled US$3,084.98 million as at October 2017, reflecting a decrease of US$52.16 million relative to the US$3,137.14 million reported as at the end of September 2017 (see figure 1).

Changes in the NIR resulted from a 1% or US$55.68 decline in Foreign Assets to total US$3,659.26 million compared to US$3,714.94 million reported for September 2017. The declined in Foreign Assets was linked to a downward movement in ‘Currency & Deposits’. As at October 2017, ‘Currency & Deposits’ totaled US$3,073.61 million reflecting a decrease of US$62.07 million compared to US$3,135.68 million booked as at September 2017. Securities amounted to US$311.44 million, US$8.07 million more than the US$303.37 million reported in September 2017. Foreign Liabilities as at October 2017 amounted to US$574.28 million. Liabilities to the IMF accounted for 100% of total foreign liabilities and reflected a marginal decrease month over month from the US$577.80 million reported for September 2017.

At its current value, the NIR is US$641.75 million more than its total of US$2,443.23 million at the end of October 2016. The current reserve is able to support approximately 38.85 weeks of goods imports or 22.50 weeks of goods and services imports.

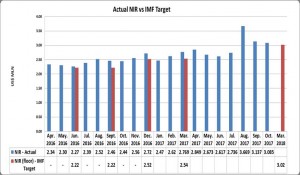

Jamaica and the IMF have entered into a New Agreement to support growth and create jobs with the international body citing, “Jamaica has made good progress under the previous IMF – support program.” As such the entity has approved a new US$1.64 billion loan for the country. According to the IMF the loan is, “intended as insurance to support the country’s ongoing reform program to tackle poverty, create jobs, and improve living standards.” As such the Net International Reserve (NIR) target outlined as per the new agreement for the 2017/18 fiscal year is US$3.02 billion (see figure 2 above). As at October 2017, the value of the Net International Reserves is above the March 2018 target.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.