February 16, 2021

For the first quarter ended December 31, 2020, Barita Investments Limited (BIL) net interest income rose by 76% amounting to $367.38 million relative to $208.62 million for the comparable quarter in 2019. “This increase was driven focused deployment of our enhanced capital position in our fixed income and credit porfolios, even as overall balance sheet expanded YoY,” as per Barita.

Dividend Income fell 86% to total $449,000 compared to the $3.22 million earned for the first three months ended December 31, 2019. Gains on sale of investment rose 165% to $669.36 million (2019: $252.14 million), while Fees & Commissions Income fell 20% to close at $465.62 million (2019: $578.73 million). According to Barita, “The decline in fees and commission income is attributable to lower performance related asset management fees during the quarter versus that of Q1 FY20 due to more challenging conditions in the local financial market.”

Foreign exchange trading and translation amounted to a gain of $485.76 million compared to a gain of $87.48 million recorded in the previous year. Other income totalled $4.92 million versus $1.38 million in a similar period in 2019. As such, net operating revenue amounted to $1.99 billion relative to $1.13 billion recorded for the comparable period in 2019.

Administrative Expenses for the period amounted to $327.42 million, increasing 32% from $247.41 million in 2019. Staff costs for the quarter rose 38% from $202.54 million booked in 2019 to $279.19 million in 2020.

BIL for the quarter reported $72.72 million for impairment, relative to the $40.96 million reported a year prior.

Profit before tax amounted to $1.31 billion relative to a profit before taxation of $640.66 million in 2019.

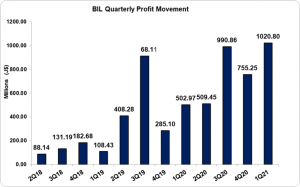

Following taxation of $293.37 million (2019: $137.69 million), the company reported net profit of $1.02 billion, relative to net profit of $502.97 million booked in 2019.

Earnings per Share for the first quarter ended December 31, 2020 totalled $0.94 relative to an earnings per share of $0.46 in 2019. The trailing earnings per share amounted to $3.02. The number of shares used in our calculations amounted to 1,085,603,093 units. BIL stock price closed the trading period on February 15, 2021 at $80.89 with a correspond P/E ratio of 26.80 times.

Notably, Management highlighted that, “Our Board and Executive teams are committed to ensuring that we play our part in supporting the battle against COVID-19 in general and continue to provide leadership as it relates to the return of a fully functional domestic capital market”.

Balance Sheet at a glance:

As at December 31, 2020, total assets amounted $69.94 billion (2019: $45.23 billion), a $24.71 billion improvement as a result of the growth in “Loans Receivables” which increased by 630% to a total of $6.20 billion (2019: $849.19 million) and “Pledged Assets” which rose 216% to $37.62 billion (2019: $11.92 billion).

Shareholders’ Equity amounted to $28.50 billion relative to $14.10 billion in 2019 resulting in a book value per share of $34.55 relative to $17.09 in 2019. This increase, noted by Management” was fuelled by:

“The injection of additional equity in the group, arising from the $13.5 billion APO and an increase in retained earnings, net of dividends declared during the period.”

DISCLAIMER:

Analyst Certification –This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.