November 12, 2019

Berger Paints Jamaica Limited (BRG),for the nine months ended September 30, 2019, reported total revenues of $1.63 billion, a 6% decrease relative to $1.73 billion reported in for the comparable period in 2018. Total revenues for the quarter totalled $534.20 million, 12% less than the $607.83 million booked in 2018. Management noted that, “revenue for the period was mainly impacted by the adverse weather conditions experienced in the quarter, that resulted in delays in construction projects.”

‘Changes in inventories of finished goods and work in progress’ dropped to $135.98 million relative to $182.61 million reported in 2018.

Total expenses for the nine months ended September 30, 2019 declined 7% to $1.72 billion compared to $1.85 billion for the same period in 2018. Of this:

-

- Raw materials and consumables used amounted to $941.22 million compared to $1.03 billion reported in 2018.

-

- Manufacturing expense fell 9% to $84.01 million (2018: $92.23 million), while depreciation climbed 20% to $28.50 million (2018: $23.73 million).

- Employee benefits expense rose to $404.23 million relative to $387.30 million in 2018.

- Other operating expense slid 17% to $261.76 million versus $314.16 million recorded in 2018.

- The Company reported other income of $540,000 a 44% decline from the $967,000 million reported last year.

The Company also booked financial cost of $376,000 relative to nil the prior year.

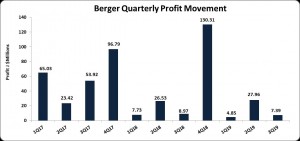

Profit before Tax for the period amounted to $50.25 million, a 20% decline relative to the $63 million reported for the comparable period in 2018. Profit before Tax for the quarter declined 35% year over year to $9.23 million (2018: $14.11 million).

BRG booked Taxation for the period of $10.05 million (2018: $19.77 million). Consequently, Net Profit for the nine months period decreased 7% to total $40.20 million when compared with the $43.24 million reported for the corresponding period in 2018. Net profit for the quarter totaled $7.39 million relative $8.97 million for the corresponding quarter in 2018.

BRG noted, “during the quarter BPJL implemented a new IT platform, Microsoft Dynamics D365O geared at improving efficiencies and productivity over the longer term. We also welcomed a new General Manager, Mr. Shashi Mahase, former General Manager of Berger Barbados, who we expect to reprise his successful performance. He replaces Barrington Graham who resigned effective October 29, 2019.” Management also noted, “as we enter the busy season, we anticipate the usual uptick in sales which, together with efficiencies being derived, should positively impact our Q4 performance.”

Consequently, Earnings per share for the period ended September 30, 2019 amounted to $0.19 (2018: $0.20) while earnings per share for the quarter amounted in $0.03 (2018: $0.04).The trailing twelve months earnings per share amounted to $0.80. The total number of shares used in the calculations amounted to 214,322,393 units. Notably, BRG’s stock price closed the trading period on November 12, 2019 at a price of $18.21.

Balance Sheet Highlights:

The company, as at September 30, 2019 recorded total assets of $1.85 billion, 2% decrease when compared to $1.89 billion recorded last year. This was due to an decline in trade and other receivables which closed at $315.87 million (2018: $513.74 million). ‘Post-employment benefits assets’ closed at $137.82 million (2018: $164.31 million). Cash and bank balances improved to $435.67 million (2018: $315.85 million) as BRG highlighted, “We continue to maintain adequate liquidity levels to enable us to respond effectively to changes in cash flow requirements.”

Total Stockholders’ equity as at September 30, 2019, closed at $1.11 billion, an 8% increase from $1.03 billion for the corresponding period last year. This resulted in a book value per share of $5.20 compared to the value of $4.82 as September 30, 2018.

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.