Date: November 12, 2019

Jamaica Producers Group Limited (JP), for the nine months, experienced a 8% increase in revenue to total $15.38 billion compared to the $14.25 billion reported in 2018. The Company posted 5% increase in third quarter revenue to $5.23 billion (2018: $4.96 billion).

The Food & Drink Division contributed a 9% increase in revenue to total $9.04 billion relative to the $8.31 billion reported in 2018. The Company highlighted that, “During the third quarter and year-to-date, the Division benefitted from a strong result in our European juice business, improved yields on our banana farms in Jamaica and solid growth in regional consumer and travel retail markets in which our JP St Mary’s and Tortuga brands trade.”

Logistics and Infrastructure increased 7% year over year to total $6.34 billion (2018: $5.94 billion). JP stated that, “During the third quarter, Kingston Wharves benefited from growing volumes of bulk, breakbulk and automotive shipments to Jamaica and the region. JP Shipping Services Limited opened its new Caribbean Logistics Centre in London during the quarter and is already consolidating and shipping commercial cargo, personal effects and vehicles to Kingston, Montego Bay and all the CARICOM countries on a weekly or fortnightly basis from this location.”

The Corporate Services division earned $3.14 million relative to $3.15 million in 2018.

The Cost of Sales for the nine months increased by 1% to total $10.12 billion compared to $9.97 billion reported for the comparable period in 2018. As a result, Gross Profits increased to total $5.26 billion, a 23% growth on the $4.28 billion documented in 2018. Gross profit for the third quarter amounted to $1.76 billion compared to $1.42 billion booked for the same quarter of 2018. Other income increased to $316.44 million, a 17% improvement relative to $271.31 million booked the prior corresponding period.

JP’s marketing, selling and distribution expenses rose 14% to close at $2.79 billion, this compares to $2.45 billion booked a year earlier. As such, profit from operations amounted to $2.79 billion relative to $2.10 billion booked for the corresponding period in 2018. Profit from operation for the quarter amounted to $955.45 million compared to $726.64 million reported for the corresponding quarter of 2018. JP also recorded a share of point in joint venture and associated company of $47.28 million relative to $31.93 million in the previous year.

Finance cost was reported at $234.34 million for the period relative to the $277.46 million reported in 2018. This resulted in a profit before taxation of $2.60 billion for the period (2018: $1.85 billion). Profit before tax for the third quarter totalled $918.76 million versus $636.07 million reported for the same quarter of 2018.

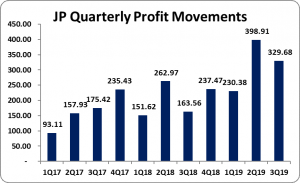

The Company incurred tax charges of $530.08 million (2018: $451.16 million). Consequently, Net Profit for the period rose 48% to $2.07 billion (2018: $1.40 billion). Net profit for the quarter amounted to $730.16 million versus $502.69 million. Notably, Net profit attributable to stockholders totalled $958.97 million; this compares to $578.15 million, a 66% rise. Net profit attributable to shareholders for the quarter went up to $329.68 (2018: $163.56 million)

Earnings per share for the period amounted to $0.85 (2018: $0.52). EPS for the quarter amounted to $0.29 (2018: $0.15), while the twelve-month trailing earnings per share amounted to $1.07. The number of shares utilized in the computations amounted to 1,122,144,036 units. JP stock last traded on November 11, 2019 at $21.84.

Balance Sheet Highlights:

As at September 30, 2019, the Company’s Assets totalled $38.61 billion, 11% more than its value of $34.78 billion a year ago. This increase in total assets was due largely to increases in ‘Securities Purchased Under Resale Agreements’ and ‘Inventories. ‘Inventories and ‘Securities Purchased Under Resale Agreements’ as at September 30, 2019 amounted to $1.02 billion (2018: $942.99 million) and $5.50 billion (2018: 4.37 billion) respectively. ‘Property, Plant and Equipment’ marginally declined to close at $21.56 billion (2018: $21.57 billion). Employee benefit asset increased 69% to $1.99 billion relative to $1.17 billion as at September 30, 2018.

The Company ended the period with equity attributable to equity holders of the parent in the amount of $13.91 billion relative to $12 billion in 2018. The company now has a book value per share of $12.39 versus $10.69 in 2018.

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.