Date: November 12, 2019

For the nine months ended September 30, 2019, Kingston Wharves’ revenue totaled $5.72 billion a 9% increase when compared to $5.26 billion for the corresponding period of the prior year, while revenue for the second quarter grew 3% to $1.92 billion (2018: $1.87 billion). This as both the company’s ‘Terminal Operations’ and ‘Logistics & Ancillary Service’ segments reported increases.

-

- The ‘Terminal Operations’ which accounted for 80% of total revenues, increased 6% year over year to a total of $4.56 billion relative to $4.28 billion last year. According to KW, “The Terminal Operations Division contributed significantly to the quarter’s performance despite the slow-down in international commerce, due to on-going trade wars and other factors that are adversely affecting the outlook for global trade and investment.”

-

- The company’s ‘Logistics & Ancillary Services’ grew 17%, to total $1.56 billion, up from $1.33 billion. The company highlighted that, “The strong performance in this business unit was driven by KWL’s consolidation of key customer relationships for our warehousing and devanning services as well as attracting new customers to utilize our logistics and supply chain management capabilities.”

Cost of sales rose 1% to a total of $2.78 billion (2018: $2.76 billion). As such, gross profit grew by 18% for the period to total $2.94 billion relative to $2.50 billion recorded a year ago. Gross profit within the second quarter rose 8% to close at $980.34 million compared to $908.03 million booked for the quarter ended September 30, 2018.

Other operating income soared year over year, to total $294.81 million (2018: $282.13 million). Administrative expenses went up by 6%, amounting to $917.03 million relative to $864.30 million for the same period last year.

As such, operating profit closed the period at $2.32 billion, 21% more than the prior year’s corresponding period of $1.92 billion. Operating profit for the quarter improved 9% to $809.83 million versus $745.45 million in 2018.

Finance costs for the year declined 19%, to close at $137.09 million for the period relative to $170.10 million booked for the corresponding period in 2018.

Profit before taxation rose 25% to $2.18 billion for the period in contrast to the $1.75 billion in 2018.

Income tax expense for the period increased 7% to $323.19 million compared to $300.65 million for the corresponding period in 2018. Consequently, net profit for the period moved from $1.45 billion to $1.86 million, a 28% growth year over year.

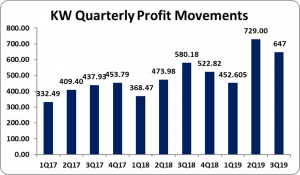

Net profits attributable to shareholders for the nine months rose by approximately 29% to total $1.83 billion relative to $1.42 billion in 2018. Third quarter profit attributable to shareholders improved 11% to close at $646.78 million. (2018: $580.18 million).

Earnings per share for the nine months ended September 30, 2019 amounted to $1.28 (2018: $0.99), while for the quarter, the EPS was $0.45 (2018: $0.41). The trailing earnings per share EPS totaled $1.64. The total number of shares used in the calculations amounted to 1,430,199,578 units. KW closed the trading period on November 11, 2019 at a price of $57.32.

Management indicated, “KWL continues to pursue a range of effective growth strategies to maintain and improve profitability in the face of significant changes in the global shipping and logistics business as a result of changing trade rules. KWL operates at the heart of the Caribbean trade and, as such, we continue to distinguish ourselves by tailoring our services directly to the needs of regional importers and exporters who depend upon timely receival and delivery of cargo via the port of Kingston as well as our investment in specialized cargo handling capabilities and systems that meet their unique needs. This direct attention to handling the cargo requirements of Caribbean businesses and connecting Caribbean producers and consumers to the world for a wide range of cargo types (including bulk, break bulk automotive and containerised cargo) has allowed the business to continue to deliver satisfactory results.”

In addition, the Company also noted, “we are building upon our established platform and track record in terminal services with the continued development of our full-service logistics capabilities. This will see us adding more warehouse space and seeking to take advantage of the Special Economic Zone legislation to attract new business, investment, trade and export opportunities to Jamaica’s manufacturing, food processing and services sector.”

Balance Sheet Highlights:

As at September 30, 2019, the company’s assets totaled $32.85 billion relative to $31.06 billion a year ago, an increase of 6%, which was driven mainly by an increase in ‘Retirement Benefit Assets’ and ‘Short-term investments’ which increased 69% and 18% respectively to total $1.99 billion (2018: $1.17 billion) and $5.02 billion (2018: $4.27 billion) respectively. Notably the company also booked $951.57 million for ‘Rights of use asset’ relative to nil the prior year.

Shareholders’ Equity amounted to $26.19 billion compared to equity of $23.86 billion reported as at September 30, 2018. As such, KW has a book value per share of $18.31 (2018: $16.68).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.