Date: August 13, 2018

C2W Music Limited (MUSIC), for the six months ended June 30, 2018, Revenue declined by 88% for the six months ended June 30, 2018, amounting to US$338 from US$2,876.

C2W incurred US$18,393 for administrative expenses, a 33% increase compared to US$13,799 last year for the comparable period.

Consequently, operating loss for the period closed at US$18,055 (2017: US$10,923). C2W reported an operating loss for the quarter of US$8,238 by 82% versus an operating loss of US$4,529 booked for the same quarter of 2018 in 2017.

The company recorded finance cost of US$2,895 for the six months relative to US$3,256 the for the prior year’s corresponding period. For the quarter, finance cost declined 9% from US$1,540 in 2017 to US$1,400.

Sponsorship income for the six months amounted to US$12,333 relative to nil twelve months earlier. The company booked US$1,500 for “Management and Consulting fee” in 2017 compared to nil in 2018.

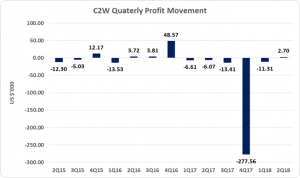

No taxes were recorded for the period. As such, the loss for the period was US$8,617, this compares with the US$12,679 net loss booked for the prior year’s corresponding period. As for the second quarter, the company reported a profit of US$2,695 (2017: US$6,069).

Loss per share (LPS) for six months period amounted to US$0.002 cents, compared to the 2017’s loss per share of US$0.003 cents for the comparable period of 2017. Earnings per share for the quarter amounted to US$0.001 cents versus a loss per share of US$0.002. The trailing loss per share amounted to US$0.001. The number of shares used in our calculations is 400,000,000.

Balance sheet at a glance:

As June 30, 2018, assets amounted to US$3,479 which was a 99% decline when compared to the US$292,871 recorded last year. The decrease was mainly due to a drop in Advances to Songwriters.

Shareholder’s deficit closed at a US$245,148 relative to a shareholder’s equity of US$54,435 in prior year’s corresponding period This resulted in a negative book value per share of US$0.0006 compared to US$0.0001 a year earlier.

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.