Date: August 13, 2018

Carreras Limited, for the three months ended June 30, 2018, reported Operating Revenue of $3.15 billion, 12% increase relative to $2.82 billion booked in 2017. The company highlighted that, “This increase over the prior period is due mainly to an increase in sales volumes albeit over a lower volume base as well as effective management of costs.”

CAR also noted that, “Based on the improved performance for the quarter, we remain cautious though optimistic regarding the outlook for the rest of the financial year. The company continues to reap the reward of continuous investment in our brands, particularly our core brands, Craven “A” and Matterhorn. The strength of our brands, people and relationships continue to position us for the future.”

The company mentioned that, “The increase in sales for the period is on a lower volume bases as a result of the excise increase implemented last year. Overall, we continue to be negatively impacted by excise increases implemented in prior periods, which in turn has unintendedly resulted in the increased illicit trade in cigarettes.”

Cost of Operating Revenue also climbed year over year by 12%, amounting to $1.57 billion from $1.39 billion. As such, Gross Operating Profit rose by 11% to total $1.58 billion relative to the $1.42 billion in 2017. Other Operating Income fell by 65% moving from $121.37 million in 2017 to $42.12 million.

Administrative, distribution and marketing expenses decreased 7% to total $490.05 million (2017: $529.41 million). Management noted that, “Continued cost-cutting, and containment initiatives are being reflected in the 7% reduction in overheads over the prior period. It is noteworthy, that this reduction was achieved despite a 2.8% increase in inflation.”

Profit before Income Tax was recorded at $1.13 billion relative to $1.01 billion in 2017. Taxation of $308.23 million was incurred for the period (2017: $255.64 million).

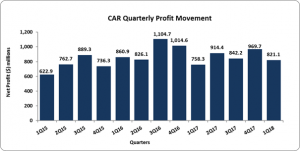

Consequently, Net Profit for the three months increased 8% to $821.09 million relative to $758.34 million booked in 2017.

The Earnings per share (EPS) for the period was $0.17 as compared to $0.16 for the corresponding period of last year. The twelve-month trailing EPS amounted to $0.73. The number of shares used in the computations amounted to 4,854,400,000 units. CAR’s stock price last traded on August 13, 2018 at $9.17.

Balance Sheet at a glance:

Total Assets amounted to $3.954 billion as at June 30, 2018, up $2.37 million from $3.952 billion reported in 20167 This was mainly due to an increase in accounts receivable totalling $975.25 million, a 38% increase year over year. however this was offset by an 11% decline in cash and cash equivalents to $2.14 billion (2017: $2.41 billion).

Shareholders’ Equity attributable to stockholders of parent amounted $1.865 billion (2017: $1.866 billion) with book value per share of $0.38 (2017: $0.38).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.