June 09, 2021

General Accident Insurance Company Limited (GENAC), for the year ended December 31, 2020 reported gross premium written of $12.04 billion, 12% higher than the $10.73 billion reported for 2019. Reinsurance ceded rose 11% to close at $9.07 billion relative to $8.15 billion booked in 2019. Excess of loss reinsurance trended up by 29% to $167.31 million (2019: $130.18 million).

As a result, net premium written increased by 15% from $2.45 billion last year to $2.81 billion for the year ended December 31, 2020. Net premium written for the fourth quarter amounted to $829.67 million relative to $801.35 million booked for the corresponding period in 2019.

Net changes in unearned premiums totalled $71.05 million, 67% lower than the $212.39 million recorded last year. Consequently, net premiums earned, for the year ended December 31, 2020, grew by 23% to a total of $2.74 billion compared to $2.23 billion for the prior year. For the quarter, net premium earned totalled $718 million compared to $698.90 million booked for the similar quarter of 2019.

Commission income fell 10%, year over year, from $857.54 million in 2019 to $771.22 million in 2020, while commission expenses increased by 3% to $465.63 million from $451.86 million documented twelve months earlier.

Claims expenses saw an increase of 51%, closing the period at $1.82 billion (2019: $1.21 billion), while management expenses climbed by 24% to total $1.23 billion compared to 2019’s total of $991.99 million.

Underwriting profit for the year totalled $1.45 million, this compares to a profit of $442.14 million in 2019. The company also made an underwriting profit of $7.64 million relative to a profit of $333.50 million within the fourth quarter of 2019.

Investment income closed at $293.89 million, an increase of 28% when compared with last year’s $229.89 million, while other income totalled $95.59 million, relative to $202.18 million in 2019. Other operating expenses grew by 21% to $116.74 million relative to $96.47 million in 2019. The Company also booked finance charges of $14.64 million for the period under review (2019: $7.57 million).

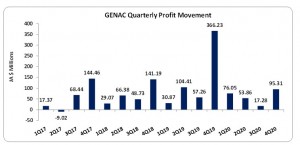

Profit before taxation amounted to $259.54 million (2019: $770.15 million). Following taxes of $65.72 million (2019: $118.60 million), net profit totalled $193.81 million for the year ended December 31, 2020, a decrease of 70% compared to the $651.56 million reported last year. Net profit for the quarter was $69.18 million, 85% less than the $459.02 million booked in the corresponding quarter in 2019.

Net profit attributable to shareholders amounted to $242.50 million (2019: $558.76 million). While, for the quarter, net profit attributable to shareholders closed at $95.31 million (2019: $366.23 million).

Total comprehensive income amounted to $255.54 million (2019: $700.96 million) for the year ended December 31, 2020, a contraction of 64%. For the fourth quarter, total comprehensive income amounted to $109.45 million (2019: $500.30 million).

As such, earning per share for the period amounted to $0.24 (2019: $0.54), while EPS for the quarter amounted to $0.09 compared to $0.36 in 2019. The stock traded at $5.82 as at June 08, 2021 with a corresponding. The number of shares used in our calculations amounted to 1,031,250,000 units.

Management stated, “During the year we also launched in Barbados. General Accident (Barbados) incurred significant start-up costs which were expected and budgeted. We expect that it will be profitable in 2021.”

GENAC further stated, “Our outlook remains positive for 2021. We expect our profitability to improve in 2021 due primarily to premium growth in Barbados and Trinidad. In addition, as the reorganization of our foreign subsidiaries is now fully completed we expect our overhead costs to stabilize. As the group continues to grow in size, we expect to achieve the scale and resilience projected by our business model.”

Balance Sheet at a Glance:-

Total assets increased by a meager 1% to $11.17 billion as at December 31, 2020 from $11.04 billion a year earlier. The is mainly as result of ‘Loans Receivables’ closing the year at $251.46 million (2019: nil) and Due from policyholders, brokers and agents increased 12% to $1.25 billion (2019: $1.12 billion). ‘Cash & short term investments’ and ‘Other receivables’ also contributed to the growth in assets with a 18% increase to $756.55 million (2019: $642.33 million) and a 45% increase to $243.58 million (2019: $167.41 million), respectively.

Shareholder’s equity as at December 31, 2020 stood at $2.58 billion (2019: $2.53 billion) resulting in book value per share of $2.50 (2019: $2.45).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.