August 18, 2021

Jamaica Producers Group Limited (JP), for the six months ended June 30, 2021, experienced a 20% increase in revenue to total $11.40 billion compared to the $9.52 billion reported in 2020. The company posted second quarter revenue of $5.92 billion, a 36% increase on 2020’s $4.36 billion. Management noted that, “During the second quarter, JP completed the acquisition of a 50% interest in Geest Line Limited (“Geest”). Geest has been in business for over 60 years and operates a fleet of ships that move refrigerated cargo as well as industrial and consumer goods and vehicles between the Caribbean, South America and Europe. The business is headquartered in Portsmouth, England. Sealines Holding N.V., a member of the Seatrade Group and a worldwide leader in reefer vessel shipping services, holds the remaining 50% interest in Geest.”

The revenue for the Food & Drink Division grew 18% to total $6.81 billion relative to the $5.76 billion reported in 2020.

Revenue in the Logistics and Infrastructure Division rose 22% year over year to total $4.60 billion (2020: $3.76 billion).

The Corporate Services division earned $66.32 million relative to $45.17 million in 2020, a 47% increase.

The cost of sales for the six months increased by 21% to total $8.11 billion compared to $6.79 billion reported for the comparable period in 2020. Nevertheless, gross profit rose to $3.29 billion, a 21% uptick on the $2.72 billion documented in 2020. Gross profit for the second quarter amounted $1.76 billion compared to $1.16 billion booked for the same quarter of 2020. Other income increased to $380.38 million, a 6% growth relative to $360.41 million booked in the prior corresponding period.

JP’s marketing, selling and distribution expenses rose 4% to close at $1.93 billion, this compares to $1.77 billion booked a year earlier. JP also recorded a share of gain in joint venture and associated company of $48.08 million, relative to loss of $4.16 million in the previous year.

Finance cost was reported at $125.47 million for the period relative to the $148.94 million reported in 2020. This resulted in a profit before taxation of $1.66 billion for the period (2020: $1.15 billion). Profit before tax for the second quarter totalled $964.26 million versus $441.86 million reported for the same quarter of 2020.

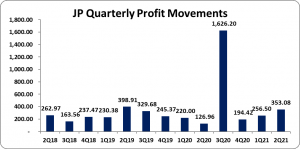

The Company incurred tax charges of $319.33 million (2020: $216.11 million). Consequently, net profit for the period rose 43% to $1.34 billion (2020: $938.19 million). Notably, net profit attributable to stockholders totalled $609.58 million; this compared to $346.97 million, a 76% increase. Net profit attributable to shareholders for the quarter rose 178% to total $353.08 million relative to the $126.96 million 2020.

Total comprehensive income for the six months ended June 30, 2021 amounted to $1.50 billion (2020: $1.26 billion). Meanwhile for the quarter, total comprehensive income totalled $987.26 million (2020: $657.30 million).

Earnings per share for the period amounted to $0.54 (2020: $0.31). EPS for the quarter amounted to $0.31 (2020: $0.11), while the twelve-month trailing earnings per share amounted to $2.17. The number of shares utilized in the computations amounted to 1,122,144,036 units. JP stock last traded on August 17, 2021 at $22.04 with a corresponding P/E of 10.18 times.

The Group highlighted that, “We view the diversity of our business as a strength. We are aware, however, that inflation, supply chain shocks and economic uncertainty related to the uneven management of the COVID-19 pandemic will all present general business challenges in the short term. We have seriously considered the current trading conditions and have positively decided to maintain an aggressive investment programme. Our strategy is to build on our core business capabilities in food and drink and logistics and infrastructure with selective capital investment projects and acquisitions. Core capital investments in our terminal, cranes and warehousing at Kingston Wharves and our filling lines at Hoogesteger are designed to expand capacity, gain market share and drive efficiency in our two largest businesses.”

Balance Sheet Highlights:

As at June 30, 2021, the company’s assets totalled $42.18 billion, 8% more than its value of $38.98 billion a year ago. This increase in total assets was due largely to increases in ‘Securities Purchased Under Resale Agreements’ which amounted to $8.85 billion (2020: $5.86 billion) and ‘Property, Plant and Equipment’ which ended at $22.95 billion (2020: $22.27 billion), respectively.

The Company ended the period with equity attributable to equity holders of the parent in the amount of $16.87 billion relative to $14.48 billion in 2020. The company now has a book value per share of $15.04 versus $12.90 in 2020.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.