MPC Caribbean Clean Energy Limited (MPCCEL), for the three months ended March 31, 2020, recorded a total expenses amount of US$39,208. The breakdown for total expenses is as followed:

- Accountancy fees closed the period at US$4,400 (2019: US$4,013).

- Administrative fees for the quarter amounted to US$28,584 versus US$26,017 recorded in the prior corresponding quarter.

- Directors’ fees closed the quarter at US$4,125 (2019: US$875) and license fees remain unchanged at US$125 when compare to last year same time.

- Insurance expenses amounted to US$656 (2019: nil) while bank charges totaled US$943 (2019: US$1,391).

- No legal and professional fees were booked relative to US$34,676 reported in the prior comparable quarter.

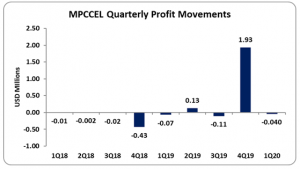

Total loss for the period was reported at US$39,208 relative to loss of US$67,472 reported for the same period last year.

Consequently, loss per share (LPS) for the three months period amounted to US$0.002 (LPS 2019: US$0.003). The trailing twelve-month EPS is US$0.004. The number of shares used in this calculation was 21,666,542 units. MPCCEL and MPCCELUS price closed the trading period at a price of JMD$169.99 and US$1 on July 28, 2020, respectively.

Management highlighted that, “The first quarter saw the business of the Company in line with the previous forecasts despite the unprecedented effects on the economic and social spheres globally caused by the COVID-19 pandemic. The main effects of the pandemic were however evident in the administrative operations of the Company. As a result, due to the international structure of the underlying investment and its investees, the established chain of reporting was impacted and therefore, caused delays in our usual financial reporting process. Sincere apologies for any inconvenience and hope for a swift recover to business as usual. To date, the operational performance of the assets were not adversely impacted by the COVID-19 global pandemic.”

Balance sheet at a Glance:

Total Assets as at March 31, 2020 closed at US$19.92 million relative to US$11.20 million booked in 2019. This increase was due to an upward movement of ‘Cash and cash equivalents’ amounting to US$10.01 million (2019: US$542,874) but was slightly altered by a decrease in ‘Investments’ which closed at US$9.91 million (2019: 10.65 million).

Shareholder’s equity totaled US$19.77 million, 81% increase when compared to US$10.94 million booked in the prior year. This resulted in a book value per share of US$0.91 compared to US$0.50 booked last year.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein