Date: March 8, 2019

Net International Reserves- February 2019

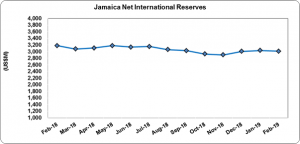

Jamaica’s Net International Reserves (NIR) totaled US$3,007.49 million as at February 2019, reflecting a decrease of US$23.46 million relative to the US$3,030.94 million reported as at the end of January 2019 (see figure 1).

Changes in the NIR resulted from a decrease in Foreign Assets of US$24.49 million to total US$3,536.84 million compared to the US$3,561.33 million reported for January 2019. ‘Currency & Deposits’ contributed the most to the decline in Foreign Assets. ‘Currency & Deposits’ as at February 2019 totaled US$2,975.68 million reflecting a decline of US$12.27 million compared to US$2,987.94 million booked as at January 2019.

‘Securities’ amounted to US$317.75 million; US$7.58 million less the US$325.33 million reported in January 2019. Foreign Liabilities for February 2019 amounted to US$529.35 million compared to the US$530.38 million reported for January 2019. Liabilities to the IMF accounted for 100% of total foreign liabilities, reflecting a US$1.03 million decline month over month from January 2019.

At its current value, the NIR is US$172.01 million less than its total of US$3,179.50 million as at the end of January 2018. The current reserve is able to support approximately 34.86 weeks of goods imports or 20.11 weeks of goods and services imports.

Figure 1

Figure 2

The country came in slightly below the benchmark of US$3.28 billion outlined by the International Monetary Fund for March 2018. Under the New Agreement, the IMF noted, “Considerable progress has been achieved on macroeconomic policies and outcomes. Fiscal discipline anchored by the Fiscal Responsibility Law has been essential to reduce public debt and secure macroeconomic stability. Employment is at historic highs, inflation and the current account deficit are modest, international reserves are at a comfortable level, and external borrowing costs are at historical lows.”

All performance criteria for the period ended December 2017 were met. The IMF further noted, “Financial sector stability is a prerequisite for strong and sustained growth. Ongoing prudential and supervisory improvements will enhance systemic stability.” “Continued reform implementation will not only safeguard hard-won gains but also deliver stronger growth and job creation.” The Net International Reserve (NIR) target outlined as per the new agreement for the 2018/19 fiscal year is US$3.22 billion (see figure 2 above). As at February 2019, the Country is US$0.21 million below targeted amount.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.