Brent Oil

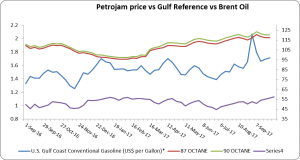

Brent oil prices increased by 1.99%, as prices increased this week. Oil traded on September 28, 2017 at a price of 57.41 (US$/ barrel).Brent oil price opened the year at 56.90(US$/ barrel).

Petrojam prices

87 Octane prices declined week over week, by 0.19% or ($0.22) . Additionally 90 Octane declined by 0.18% week over week or ($0.22) . 87 Octane and 90 Octane opened the year at J$97.32 and J$98.98 respectively and now trades at J$117.29 and J$120.12 per litre .

Figure 1: Petrojam, U.S. Gulf Coast Conventional Gasoline Regular and Brent Crude Oil 1 Year Price History

This Week in Petroleum

Crude oil and petroleum product exports reach record levels in the first half of 2017

Crude oil exports in the first half of 2017 increased by more than 300,000 barrels per day (b/d) from the first half of 2016, a 57% increase. Petroleum product exports grew over the same period as well. Crude oil and propane exports each reached record highs of 0.9 million b/d, and distillate exports reached a record of 1.3 million b/d.

Although crude oil exports during the period grew, the growth rate in the first half of 2017 was lower than in the first halves 2013, 2014, and 2015 when exports increased at year-over-year rates of 88%, 134%, and 70%, respectively. Following the removal of restrictions on exporting U.S. crude oil in December of 2015, crude oil exports have been characterized by greater volatility. The range between the highest and lowest monthly exports in the first half of 2017 was 370,000 b/d, compared with 334,000 b/d in the first half of 2016. These levels are also greater than ranges in recent history of 161,000 b/d in 2015 and 147,000 b/d in 2014. Prior to 2014, crude oil exports tended to fluctuate less, with ranges commonly less than 100,000 b/d (Figure 1).

Distillate exports in the first half of 2017 outpaced those in the first half of 2016 by 14%, with exports to South and Central America accounting for nearly 70% (114,000 b/d) of this growth. As a result, the share of distillate exports to Central and South America increased slightly to 56%, while the share of exports to Western Europe fell to 19%. Mexico remained the largest single destination for U.S. distillate averaging 17% of total exports (223,000 b/d), followed by Brazil at 14% (180,000 b/d), and the Netherlands at 6% (81,000 b/d).

In the first half of 2017, despite consistently strong domestic demand, U.S. exports of total motor gasoline averaged a record high of 756,000 b/d, a 3% increase from the first half of 2016. High levels of domestic production of gasoline contributed to this record-high export level. Exports to Central and South America saw strong growth, increasing 24% over the first half of last year.

https://www.eia.gov/petroleum/weekly/