January 4, 2020

138SL’s revenue increased by 20% to $1.22 billion relative to the $1.01 billion recorded for 2019. Other operating income increased for the year under review, by 159% to $107.43 million from $41.50 million reported for the year ended September 30, 2019. Revenue for the fourth quarter declined to $221.36 million (2019: $362.29 million), while other operating income rose by 24% to $17.10 million (2019: $13.74 million).

Administrative expenses decreased by 5% to $757.57 million (2019: $794.03 million). Administrative expenses for the quarter experienced a 8% increase to $250.93 million (2019: $233.05).

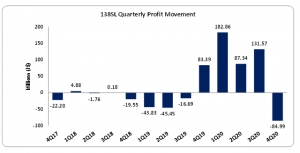

Operating profit for the year amounted to $567.73 million, an increase of 118% compared to $260.92 million reported for the year prior. For the fourth quarter, operating loss closed at $12.47 million, relative to a profit of $142.98 million booked in 2019.

The Company also reported finance cost of $257.36 million (2019: $280.53 million), an 8% decrease year on year. For the quarter, finance cost fell by 12% to close at $62.03 million (2019: $70.62 million).

Profit before taxation for the year end amounted to $310.37 million, significant improvement from 2019 loss of $19.61 million. The Company explained, “This result continues to be positively impacted by: (i) effective management of operating costs (primarily utilities) and (ii) variation claims relating to Irvine Hall. The latter item includes a variation claim for the full year 2019 as well as the claim for the year 2020. Adjusting for the variation claims, the group recorded year-to -date profit amounting to $78M.” Loss before taxation for the quarter amounted to $12.47 million relative to a profit of $142.98 million booked twelve months earlier.

Following tax credits of $6.41 million (2019 tax credit: $42.58 million), net profit totalled $316.78 million, compared to a net profit of $22.97 million in the same period last year. Net loss for the quarter amounted to $84.99 million relative to a net profit of $83.39 million in the prior comparable period.

Earnings per share (EPS) for the period was recorded at $0.76 relative to an earnings per share of $0.06 a year earlier. Loss per share for the quarter totalled $0.21 in contrast to an earnings per share of $0.20. The number of shares used in this calculation was 414,500,000. As at December 31, 2020, the stock traded at $4.84 with a corresponding P/E of 6.33.

138SL noted, “The Covid-19 pandemic has had a negative impact on our long-term occupancy revenues which saw occupancy before March 2020 of 99% falling to levels below 20%. This translates into a reduction in long term rental revenue for the fourth quarter of approximately $101M.”

Furthermore, “The University of the West Indies moved classes online for the first semester effective September 7, 2020. As a result, students who had previously applied for on-campus accommodation, decided to defer their accommodation requirement to the next semester.” the Company mentioned.

Balance Sheet at a Glance:

As at September 30, 2020, ‘Total Assets’ decreased by 8% to $10.08 billion (2019: $11.04 billion). This decrease was primarily driven by a 13% decrease in ‘Financial asset-service commission rights’ to $8.86 billion from $10.18 billion recorded twelve months earlier. The overall decline was tempered by ‘Receivables’ which recorded a 162% growth to $619.95 million versus $295.90 million in 2019.

‘Total Shareholders’ Equity totalled $4.53 billion (2019: $5.55 billion), which resulted in a book value of $10.94 (2019: $13.38).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.