Date: August 29, 2018

For the year ended March 31, 2018, 1834 Investments Limited (1834), revenue declined by 25% from $60.78 million for the comparable period in 2017 to $45.38 million. For the quarter, the Company generated revenue of $10.57 million, a 49% decline year over year.

Other operating income fell by 16% to $116.02 million (2017: $138.24 million). Consequently, total income for the period decreased by 19% to $161.40 million relative to $199.02 million for the comparable period last year. the company attributed the movement to, “lower interest income and reduced year over year gains from asset disposals.” Total Income declined 48% for the quarter to $51.49 million relative to $98.81 million for the fourth quarter in 2017.

Total expenses increased by 12% from $104.13 million in 2017 to $116.88 million in 2018. Of total expenses, administrative expenses went up 64% to close at $31.23 million (2017: $19.09 million), while other operating expenses slightly rose by 1% to $85.63 million (2017: $85.04 million). Total expenses for the quarter amounted to $58.53 million, 101% more than last year’s comparable period of $29.15 million. Management noted, “the variance was driven by one-off expenses incurred for the aforementioned early termination of a fifteen year obligation to Radio Jamaica Limited and by higher professional fees, which were offset by reduced administration costs. In the period the company engaged a new accounting firm to streamline its financial reporting.”

As such, profit from operations dipped by 53% from $94.90 million to $44.51 million for the year end. Loss from operations for the quarter totalled $7.05 million versus a profit of $69.66 million for the respective quarter ended March 31, 2017.

Finance costs dropped 86% from $2.71 million in 2017 to $380,000 for the comparable period in 2018. As such, profit from continuing operations before other income fell 52% to $44.13 million relative to $92.19 million booked in 2017.

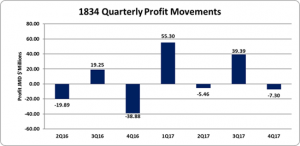

Tax charges of $15.24 million were incurred for the year end, compared to $89.89 million the prior year. Consequently, profit for the year end amounted $81.93 million relative to $12.35 million for 2017. The company however recorded a loss of $7.30 million (2017: $38.88 million) for the fourth quarter.

The Earnings per share for the year amounted to $0.07 (2017: $0.01). For the quarter, the Loss per share amounted to $0.006 versus a LPS of $0.032. The number of shares used in this calculation was 1,211,243,827 units. As at August 28, 2018, the stock traded at $0.99.

Management also noted, “during the period we continued to streamline operations for greater efficiency and commenced the process to wind up its non-operational subsidiaries. Accordingly, the overseas subsidiary 1834 Investments (Canada) Inc. was dissolved (subsequent to the year-end) and four other dormant subsidiary companies are in the process of wind up.”

Balance Sheet Highlights:

The company, as at March 31, 2018, recorded total assets of $1.75 billion, a decrease of 7% when compared to $1.88 billion recorded last year. The movement was attributed to a 23% decline in Property, plant and equipment which closed at $10.85 million (2017: $15.64 million). Also, there was a significant increase in Cash and Cash Equivalents, by 781%, to $67.63 million (2017: $7.68 million).

Total Stockholders’ Equity as at March 31, 2018 closed at $1.70 billion, a 4% fall from $1.78 billion the prior year. This resulted in a book value of $1.41 compared to the value of $1.47 as at March 31, 2017.

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.