May 18, 2020

Eppley Caribbean Property Fund Limited (CPFV)

For the six months ended March 31, 2020: –

Reported in Barbados Dollars unless otherwise indicated:

Eppley Caribbean Property Fund Limited (CPFV), for the six months ended March 31, 2020 reported net rental income of $1.69 million (2019: $730,771), a 132% increase. In addition, share of profit of investments accounted for using the equity method decreased from $1.06 million in 2019 to $1.05 million for the six months ended March 2020.

Fair value losses on investment amounted to $220,477 relative to a gain of $40,000 in 2019. The Company stated, “The Fund’s other key performance measures, net operating income (NOI) and funds from operations (FFO) attributable to shareholders, noted significant growth as well. This reflects the addition of new properties, mostly in Jamaica, that have further diversified our stream of cashflows.”

Interest income amounted to $400,360 versus $65,890 booked for the corresponding six months last year. No other income was reported for 2019 and 2020 six months.

As such, total investment income increased to a total of $2.92 million (2019: $1.90 million). For the second quarter ended March 31, 2020, total investment income amounted to $1.26 million (2019: $919,822).

Total operating expenses amounted to $1.24 million (2019: $650,807). Total operating expenses can be broken down as follows:

-

- Interest expenses totalled to $246,556 (2019: $241,205).

- Fund management fees was $328,170 compared to $147,542 booked for 2019 six months.

- Professional fees totalled $213,475 (2019: $93,121).

- Directors and subcommittee fees closed at $1,600 (2019: $1,280).

- Office and administrative fees went up to $21,682 (2019: $9,030).

- Impairment recovery for receivables closed the six months at $26,559 relative to an impairment charge of $11,087 in 2019.

- Investment advisor fees totalled $328,170 (2019: $147,542).

Total operating expense for the second quarter ended March 31, 2020 amounted to $795,475 (2019: $350,277).

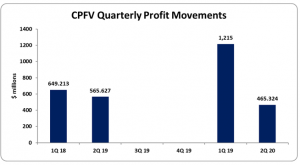

Profit before tax for the six months ended March 31, 2020 closed at $1.68 million (2019: $1.25 million). Whereas, profit before tax for the second quarter ended March 31, 2020 totalled $465,323 (2019: $565,545).

Profits attributable to shareholders for the six months amounted to $1.68 million compared to $1.21 booked prior corresponding period. While, profit attributable to shareholders for the second quarter ended March 31, 2020 totalled $465,623 (2019: $565,627).

Consequently, total comprehensive income for the period closed at $1.69 million compared to $1.25 reported for 2019’s corresponding period. Total comprehensive income for the second quarter ended March 31, 2020 totalled $479,711 (2019: $569,545).

Earnings per share for the six months ended March 31, 2020 totalled 1.38 cents compared to EPS of 0.99 cents for the corresponding period in 2019. The second quarter’s EPS amounted to 0.38 cents (2019: 0.46 cents). Trailing EPS amounted to 3.53 cents. The total amount of shares outstanding used for this calculation was 122,181,628 units. CPFV closed the trading period at JMD $32.28 on May 15, 2020.

CPFV noted, “The Fund’s performance was weighed down by a high cash balance which stood at $28.2 million at the end of the quarter. In March, we were preparing to close on two large acquisition opportunities that met our return thresholds and would have meaningfully deployed our liquidity. However, with the advent of Covid 19, we thought it prudent to put these opportunities on hold. This decision will prolong the drag of cash on our earnings. We believe it will also provide us with the opportunity to acquire commercial properties on significantly improved terms as the effects of Covid 19 manifest throughout the region. As a large cash buyer, the Value Fund is well-positioned to work with sellers looking to dispose their properties quickly and without financing contingencies.”

Furthermore, Management added, “The Fund will not be immune to the impacts of Covid 19. We enter this period with over 90% occupancy and mostly multiyear leases with well-capitalized tenants. Our decision last year to raise capital and acquire office and industrial assets will also act as an additional mitigant. Nevertheless, our retail assets and specifically those exposed to tourism will be affected. We expect to provide short-term rent relief to some tenants and this will impact our FFO and earnings in 2020. We are however confident that in most cases we will be able to simply defer the payment of rent or significantly extend leases with our tenants to offset the impact over the long-term. In these times of economic uncertainty and volatility in stocks and bonds, we are pleased to own a high-quality portfolio of real assets.”

Balance Sheet Highlights:

As at March 31, 2020, total assets amounted to $99.09 million, 95% more than prior corresponding period’s $50.71 million in 2019. This was attributed to a rise in ‘Investment properties’ which closed the period at $48.32 million (2019: $17.81 million). Additionally, the growth in ‘Cash and Cash Equivalents’ and ‘Investments in associated companies’ contributed to the overall increase in the company’s assets, closing at $28.24 million (2019: $11.87 million) and $21.32 million (2019: $19.48 million), respectively.

CPFV, as at March2020, booked total shareholders’ funds of $86.80 million (2019: $39.61 million), which translated into a net asset value per share of $0.71 (2019: $0.32).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.