March 16, 2023

Main Event Entertainment Group Limited (MEEG)

For the three months ended January 31, 2023:-

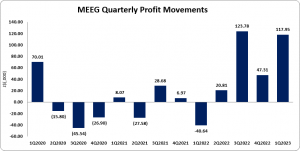

Main Event Entertainment Group Limited (MEEG) for the three months ended January 31, 2023 recorded $627 million in revenue compared to $201.72 million booked for the period ended January 31, 2022, a 211% increase. The Company noted, “This marks the second largest quarterly performance and the strongest ever January performance. The company’s performance continues to be driven by the resurgence of entertainment, promotional and marketing activities, following a return to pre-covid market conditions.”

Direct expenses for the quarter rose by 156% to $314.38 million relative to the $122.72 million recorded in the prior corresponding period. Gross profit for the period grew by 296% to $312.61 million (2022: $79 million). Speaking to gross margins, management stated, “Continuing with our emphasis on operational efficiency and cost containment efforts, gross profit for the quarter was $312.611M. Compared to January 2022, this represents an increase of 296%, and importantly, saw our gross margins improve to 50%, up from 39% in the corresponding period. In addition to our operational efficiency and cost containment efforts, the company benefited from improvement in sales activities from revenue streams that requires little external support.”

MEEG booked other income of $3.05 million for the quarter, 46 times Q1 2022 figure of $66,000.

Total expenses rose by 57% to $183.65 million versus $117.06 million recorded for 2022. Of this, administrative and general expenses grew by 72% to $144.15 million (2022: $83.78 million), while depreciation expense decreased 6% to $30.50 million (2022: $28.77 million). Selling and promotion expense went up by 364% to $6.52 million relative to the $1.40 million booked last three months. According to MEEG, “This increase was primarily driven by increased execution activities and the resulting associated costs. Increased staff costs resulting from bolstering of our staff complement, automobile related expenses, advertising and promotions activities accounted for 87% of the $66.5M increase.”

Consequently, operating profit for the period rose to $132 million (2022: operating loss of $38 million).

Finance cost contracted 26% to $2.52 million (2022: $3.40 million) at the end of January 2023. Management attributes this decline in finance costs to a reduction in “debt exposure.”

MEEG recorded profit before taxation of $129.49 million relative to a loss before taxation of $41.40 million reported in Q1 of 2022.

The company reported tax charge of $11.54 million (2022 tax credit: $758,000) during the period, resulting in net profit totaling $117.95 million compared to the $40.64 million reported in 2022. Management noted that, “It is important to note that the company benefitted from its final quarter of 100% tax remission at the end of January 2022.”

Earnings per Share (EPS) for the three months ended amounted to $0.39 (2022 LPS: $0.14). The trailing EPS amounted to $1.03. The number of shares used in the calculation was 300,005,000 units. Notably, MEEG stock price closed the trading period on March 15, 2023 at a price of $12.10 with a corresponding P/E ratio of 11.72 times.

Balance Sheet Highlights:

As at January 31, 2023, the company’s assets totaled $1.17 billion (2022: $824.76 million), $349.21 million more than its value in Q1 2022. This growth in total assets was largely driven by a 113.8% increase in ‘Receivables’ which amounted to $290.20 million (2022: $135.74 million). ‘Deposit – short term’ also contributed to the upward movement adding $153.15 million to Total Assets. This ‘Deposit -short term’ line item represents an amount invested for greater than 90 days but less than 1 three months at a rate of 5.75% per annum.

Equity attributable to stockholders of the company amounted to $788.95 million (2022: $509.11 million). This translated to a book value per share of $2.63 relative to $1.70 for the corresponding period in 2022.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.