August 21, 2024

The Monetary Policy Committee (MPC) of the Bank of Jamaica (BOJ) met on August 16 and 19, 2024, and reviewed its recent monetary policy measures, deciding on a three-pronged approach:

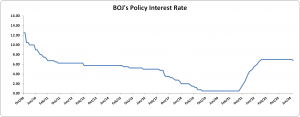

- Policy Rate Reduction: The MPC reduced the policy rate by 25 basis points to 6.75% per annum, effective August 21, 2024.

- Gradual Liquidity Adjustment: They continued the gradual reduction of the BOJ’s absorption of liquidity from deposit-taking institutions (DTIs) through open market operations.

- Foreign Exchange Market Stability: The MPC aimed to preserve relative stability in the foreign exchange market.

The MPC noted that its previous decision on June 28, 2024, to gradually reduce the absorption of liquidity has already injected $20.5 billion into the system. This move resulted in a 105 bps reduction in the interest rates on BOJ’s 30-day Certificates of Deposit, leading to a decline in treasury bill rates by 20 bps to 72 bps between July 1, 2024, and the present.

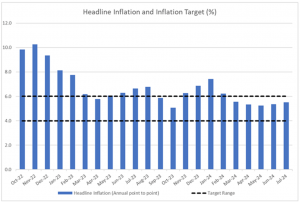

The Committee concluded that inflation is increasingly anchored within the Bank’s target range of 4.0 to 6.0 per cent. In July 2024, annual headline inflation was 5.1 per cent, marking the fifth consecutive month within the target range. Core inflation, excluding agricultural food products and fuel, stood at 4.5 per cent, reflecting a steady decline in underlying inflation since the start of 2024.

In making its decision, the MPC acknowledged that despite the impact of Hurricane Beryl, inflation is expected to stay within the Bank’s target range over the next two years. However, inflation is projected to temporarily exceed the upper end of the target range from August to December 2024 due to the hurricane’s impact on agricultural supplies. After this period, inflation is expected to return to the target range.

Economic conditions support low, stable, and predictable inflation going forward. The Government’s fiscal policy, focused on post-hurricane recovery, is expected to have no near-term impact on inflation. The lagged effects of the Bank’s tight monetary policy are moderating domestic demand, as seen in lower new domestic currency loans and easing wage pressures. Inflation expectations are declining, and the exchange rate remains stable, with international commodity prices and U.S. inflation trends favorably influencing domestic prices.

The risks to the inflation outlook are balanced, with potential upward pressure from rising international shipping costs and adverse weather, including the impact of Hurricane Beryl. Conversely, weaker global growth could lead to lower inflation. The MPC emphasized that any future rate cuts will depend on incoming data

Source: Bank of Jamaica

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.