April 30, 2025

Supreme Ventures Limited(SVL)

Unaudited financials for the first quarter ended March 31, 2025:

Supreme Ventures Limited (SVL), for the first quarter ended March 31, 2025, reported a 4% increase in Total Gaming Income from $13.25 billion in 2024 to $13.83 billion in 2025. Gross ticket sales were $31.03 billion (Q1 2024: $28.69 billion) on SVL’s core product line of Lottery.

Revenue from non-fixed odd wagering games, horse racing, and pin codes rose by 5%, reaching $8.45 billion in the first quarter of 2025, up from $8.05 billion in the previous year. This increase reflects steady consumer participation and engagement growth across these gaming categories according to the Company.

Additionally, Income generated from fixed-odds wagering games, after accounting for prize payouts, experienced a 3% increase, totaling $5.37 billion in 2024 compared to $5.20 billion in 2024. SVL noted that total revenue across all of their main operating segments grew, whilst their payout ratios exceeded 70% on core lottery products. Management stated that, “this underlines out commitment to providing our customers with a positive gaming experience and life changing returns on their investment.”

Direct Expenses rose 4% to $10.67 billion (2024: 10.29 billion). Gross Profit for the quarter ended March 31, 2025, inched up 6% to $3.22 billion (2024: $3.04 billion).

Selling, general and administrative expenses for the three months increased 32% to $2.22 billion (2024: $1.68 billion).

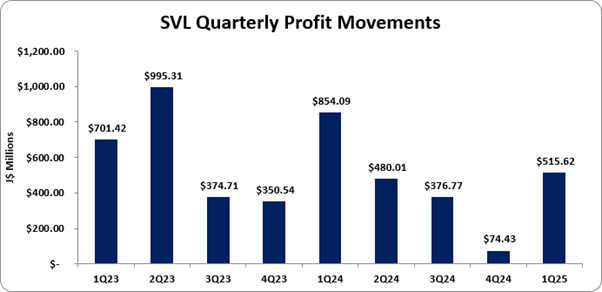

Operating Profit for the quarter ended March 31, 2025, decreased 33% to $952.94 million (2024: $1.43 billion).

Finance Costs for the three months slid 2% to $220.23 million (2024: $225.84 million).

Profit before taxation for the three months decreased 39% to $732.72 million (2024: $1.20 billion). Taxation for the three months decreased 35% to $217.10 million (2024: $334 million).

Profit Attributable to shareholders for the three months decreased by 40% to $515.62 million (2024: 855.92 million).

Consequently, Earnings Per Share for the three months amounted to $0.20 (2024: EPS: $0.32). The twelve-month trailing EPS was $0.55, and the number of shares used in these calculations was 2,637,254,926.

Notably, SVL’s stock price closed the April 30, 2025, trading period for $19.99 with a corresponding P/E ratio of 36.26x.

Balance Sheet Highlights

The Company’s assets totaled $20.78 billion (2024: $22.15 billion). The Company’s balance sheet decline is mainly due to a reduction in cash and bank balances, which closed at $1.20 billion. Additionally, inventories fell to $183.87 million compared to $433.90 million in the prior year.

Shareholder’s equity was $5.03 billion (2024: $5.12 billion), representing a book value per share of $1.91 (2024: $1.94).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.