July 1, 2025

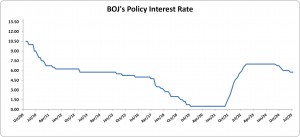

The Bank of Jamaica’s (BOJ) Monetary Policy Committee (MPC), at its meetings on 25 and 26 June 2025, decided to maintain its current monetary policy stance, keeping the policy interest rate at 5.75% per annum. This decision reflects the Committee’s view that the existing policy is appropriate to support inflation remaining within the target range of 4.0% to 6.0% over the next two years, despite heightened global uncertainties. These include ongoing geopolitical tensions and shifts in global trade policies, which have increased the risk of inflation rising above projections.

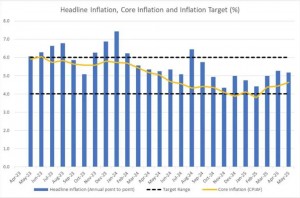

Inflation in Jamaica has remained stable within the target range since September 2024. As of May 2025, annual headline inflation stood at 5.2%, consistent with the previous year, while core inflation was 4.6%, remaining below the upper limit of the target since July 2023. The BOJ noted that private sector inflation expectations have stabilized, and international commodity prices—such as grains, oil, and liquefied natural gas—have generally declined. However, the Bank remains cautious, acknowledging that prolonged geopolitical tensions could reverse these trends and exert upward pressure on prices.

The MPC also considered the broader economic outlook, projecting real GDP growth between 1.0% and 3.0% for FY2025/26, driven by expansions in the Mining, Tourism, and Construction sectors. Preliminary indicators suggest economic growth in the June 2025 quarter, particularly from tourism and related services. Meanwhile, the domestic banking system remains sound, and fiscal policy is not expected to pose inflationary risks in the near term.

Internationally, inflation in the United States rose slightly to 2.4% in May 2025, remaining above the Federal Reserve’s 2.0% target. The Fed has held its interest rate steady at 4.25%–4.50%, citing persistent but reduced uncertainty in the economic outlook. Commodity price movements were mixed, with oil prices rising in June due to Middle East tensions, while LNG and grain prices showed declines or smaller-than-expected increases.

In conclusion, the BOJ reaffirmed its commitment to maintaining low and stable inflation and pledged to continue monitoring economic developments closely. The next monetary policy decision is scheduled for 20 August 2025.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.