November 20, 2025

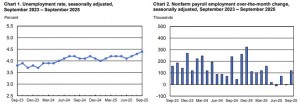

According to the U.S. Bureau of Labor Statistics, total nonfarm payroll employment rose by 119,000 in September, while the unemployment rate remained relatively stable at 4.4%. Employment saw notable increases in health care, food services and drinking places, and social assistance, whereas transportation and warehousing and federal government experienced declines. These findings are based on two monthly surveys: the household survey, which measures labour force status, including unemployment by demographic characteristics, and the establishment survey, which assesses nonfarm employment, hours, and earnings by industry.

The BLS highlighted, “Publication of the September 2025 Employment Situation report was delayed by over six weeks due to a federal government shutdown. Household survey data for September were collected on schedule, while establishment survey estimates include both pre-shutdown data and business self-reports during the shutdown, resulting in a higher-than-usual collection rate of 80.2%. No October 2025 Employment Situation report will be released; establishment survey data for October will be combined with November data, while household survey data for October were not collected and will not be retroactively gathered. The November report, covering both months, is scheduled for release on December 16, 2025.”

Household Survey Data

In September, the unemployment rate held at 4.4%, with 7.6 million people unemployed. The rates for major worker groups showed little change, except for adult women (4.2%) and Asians (4.4%), which increased. Adult men (4.0%), teenagers (13.2%), Whites (3.8%), Blacks (7.5%), and Hispanics (5.5%) remained stable.

The number of long-term unemployed was 1.8 million, accounting for 23.6% of all unemployed individuals.

The labour force participation rate (62.4%) and the employment-population ratio (59.7%) showed little change, with the latter down 0.4 percentage point over the year. The number of people employed part-time for economic reasons remained at 4.6 million.

The number of people not in the labour force who wanted a job decreased to 5.9 million, down by 421,000 over the month. Among them, 1.7 million were marginally attached to the labor force, and 557,000 were discouraged workers who believed no jobs were available for them.

Establishment Survey Data

In September, total nonfarm payroll employment increased by 119,000, continuing a trend of minimal change since April. Notable job gains occurred in health care (+43,000), with growth in ambulatory health care services (+23,000) and hospitals (+16,000). Food services and drinking places added 37,000 jobs, while social assistance rose by 14,000, driven by gains in individual and family services (+20,000).

Transportation and warehousing employment declined by 25,000, including losses in warehousing and storage (-11,000) and couriers and messengers (-7,000). Federal government employment fell by 3,000 and is down by 97,000 since January.

Employment in other major industries—including mining, construction, manufacturing, wholesale trade, retail trade, information, financial activities, professional and business services, and other services—showed little change over the month.

Average hourly earnings for all employees on private nonfarm payrolls increased by 9 cents to $36.67, marking a 3.8% rise over the past year. The average workweek for all employees remained unchanged at 34.2 hours, with production and nonsupervisory employees edging up by 0.1 hour to 33.7 hours.

Revisions for July and August showed a net decrease of 33,000 jobs, with July revised down by 7,000 to +72,000 and August revised down by 26,000 to -4,000. These revisions resulted from additional reports and recalculations of seasonal factors.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.