AMG Packaging and Paper Company Limited (AMG) for the year ended August 2017 recorded turnover in the amount of $660.25 million (2016: $628.67 million), an increase of 5% when compared to 2016, while for the quarter turnover was up 5% to close at $173.23 million (2016: $165.36 million). Management noted, “it was another challenging year for AMG mainly due to the underperformance of our Toilet Paper division and the decision has been taken to discontinue the production of Toilet Paper by the end of the second quarter.”

Total cost of sales amounted to $506.26 million, an increase of 10% relative to the corresponding period in 2016 of $458.43 million. Contributing to the increase in cost of sales was cost of materials used which rose $30.35 million year over year to $349.93 million (2016: $319.58 million).

Consequently, gross profit amounted to $154 million, 10% down from $170.24 million reported for the comparable period of 2016. For the quarter of 2017 gross profit was down 35% to close at $17.94 million relative to $27.56 million in 2016.

Administrative expenses grew by 23% to close at $87.64 million versus $71.05 million reported in 2016. Financial costs also increased year over year by 2% to total of $12.36 million (2016: $12.12 million). Selling and distribution expenses recorded a 9% growth from $9.31 million booked in 2016 to $10.12 million for year ended August 31, 2017.

Other income for the year rose from $6.66 million in 2016 to close at $7.23 million, an 8% increase relative to the prior year.

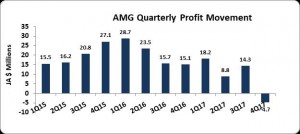

As such, Pre-tax profit closed at $51.10 million for 2017, 39% less than the $84.43 million booked for 2016. The company incurred taxes of $14.48 million compared to $1.46 million reported in 2016. Consequently, net profit attributable to shareholders amounted to $36.62 million, a decrease of 56% relative to net profit of $82.97 million in 2016. Net loss for the quarter amounted to $4.70 million compared to a profit of $15.14 million reported in 2016.

Earnings per share for the year amounted to $0.07 (2016: $0.16), while the loss per share for the quarter was $0.01. This compares to an EPS of $0.03 for the corresponding quarter of 2016. The number of shares used in our calculations amounted to 511,894,285 units.

AMG stated, “the Board has engaged the services of a consultant to do an evaluation of our entire operations which should be completed by mid-December, at which time we will be guided accordingly.” Management also highlighted, “we are currently transitioning from our ISO 9001:2008 to the new standard ISO 9001:2015. This is scheduled to be completed by September 2018.”8

Balance Sheet Highlights:

As at August 31, 2017, total assets amounted to $688.94 million, 17% more than its value a year ago. Property, plant & equipment totaled $388.87 million (2016: $281.57 million). Accounts receivables net allowances also contributed to the movement in the overall asset base with a 10% growth to $110.44 million (2016: $100.16 million).

Shareholder’s Equity as at August 2017 totaled $484.68 million (2016: $421.18 million) resulting in a book value per share of approximately $0.95 (2016: $0.82).