Date: May 21, 2019

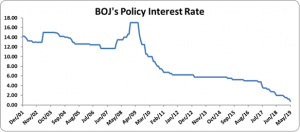

The Bank of Jamaica (BOJ) held its Quarterly Monetary Policy Press Conference today, where the Governor, Mr. Brian Wynter, commented on the Bank’s decision to lower the policy interest rate by 50 basis points to 0.75% per annum.

According to the Governor, “this policy decision reflects the Bank’s forecast that, even though headline inflation will increase to average 4.5% over the next two years, there will be months when inflation will fall below the lower limit of the inflation target of 4% to 6%. In addition, notwithstanding the uptick in annual inflation, core, or underlying, inflation is projected to remain low. In the period that follows, headline inflation is forecasted to approach the midpoint of the target gradually but, at a slower pace than we had expected at the last assessment in February 2019.”

As a result of increasing the pace of private sector credit expansion, increased economic activity will be stimulated by businesses and households across Jamaica. With there being more economic activity, this will bring with it a bit more inflation, which will support inflation returning to the centre of the target more quickly.

Bank of Jamaica’s next monetary policy decision announcement is scheduled for Thursday, 27 June 2019.

Other Actions

The Bank of Jamaica announced that, “in addition to the decision to lower the policy rate, the BOJ reduced the cash reserve requirement by two percentage points to 7%, effective June 03, 2019. This second reduction in the cash reserve requirement will increase liquidity in the financial system by $12.3 billion, thereby supporting the provision of more credit to businesses and households at lower rates and on better terms.”

In addition, there was also a reduction in the width of the interest rate corridor from 300 basis points to 200 basis points. The Governor noted that, “narrowing the width of the corridor is aimed at strengthening the effect of the changes in the policy rate on the interest rates the public pays when they borrow from banks and other financial institutions and the interest rates the public receives on their bank deposits and other investments.”

Inflation Performance Relative to Target & Revised Outlook

Notably, Mr. Wynter indicated that, “in STATIN’s latest release, annual inflation rate is 3.9% , up from 3.4% at March 2019 and 3.2% at April 2018.” This means that inflation has been increasing. He further mentioned that, “this mainly reflected the impact of some normalization in the prices of agricultural food items, particularly vegetables and some processed foods, partly offset by a decline in electricity rates. At the same time, inflation remained below the target for the fifth month in a row and also that underlying inflation remained low.”

Looking ahead, Mr. Wynter indicated “inflation is projected to increase to 5%, the mid-point of the target, by the March 2020 quarter as domestic agriculture prices increase from the low levels of recent months to more normal level and domestic economic activity increase in response to the lowering of the policy rate over the last eight quarters.” It should be noted that the Bank does not expect inflation to stay at the mid-point of the target; rather the Bank expects that inflation will decline towards the bottom of the target in the quarters after March 2020 and only return to the mid-point slowly over the ensuing three years.

Risks to the Forecast

The Bank assessed the risks to the inflation forecast to be generally balanced over the next two years but however outlined the downside and upside risk that would cause inflation to deviate from projections.

Downside Risks

The main downside risk that would result in inflation being lower than forecasted includes:

- Production in the agricultural sector that would lead to smaller increase in food prices

- Demand for Jamaican exports and therefore domestic economic activity, given that global trade tensions escalate

Upside Risks

The main upside risk that would result in inflation being higher than forecasted are as follows:

- International commodity prices (crude oil in particular)

Nonetheless, Mr. Wynter indicated that the prospects for the Jamaican economy are positive, as economic growth continues with rising employment. “Inflation is low, stable and predictable. However, the economy continues to operate below its potential in that there exists spare capacity that can be used for the production of goods and services but is not being used,” as stated by the Bank. Furthermore, as mentioned by the Bank, “this is why the Bank believes that there is room to accommodate more growth without compromising our ability to meet the inflation target. Additionally, this is why Bank of Jamaica is maintaining an accommodative monetary stance to support a faster return of inflation to the centre of the target in the period after March 2020.”

In concluding, Mr. Wynter ended on the note that, “Jamaica’s macroeconomic indicators continue to reflect entrenched stability. Foreign reserves are above the level deemed adequate and the current account deficit remains low and sustainable. Market interest rates are at record lows and fiscal performance continues to be strong.”

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.