Date: November 21, 2019

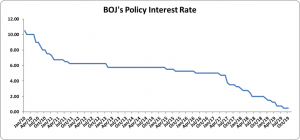

The Bank of Jamaica (BOJ) held its Quarterly Monetary Policy Press Conference today, where the Governor, Mr. Richard Byles, commented on the Bank’s decision to maintain the policy interest rate at 0.50% per annum.

According to the Governor, “this policy decision reflects the Bank’s continued assessment that monetary conditions are generally appropriate to support the achievement of the Bank’s inflation target of 4% to 6% over the next eight quarter. In addition, the Bank’s inflation target was set by the Government to facilitate a faster pace of economic growth while at the same time supporting the country’s ongoing debt reduction strategy.”

Bank of Jamaica’s next monetary policy decision announcement is scheduled for Friday, 20 December 2019.

Inflation Outlook

Notably, Mr. Byles indicated that, “in STATIN’s latest release, the prices faced by consumers in Jamaica rose by 3.3% for the year leading up to October 2019 versus 4.7% for the same period last year. The largest contributor to the inflation rate was Food and Non-Alcoholic Beverages (a category within the CPI) which rose by 5.9% over the year. Education also increased by 6.4% which reflected increase in school fees. However, the category Housing, Water, Electricity and Gas fell 1% over the year. This was driven by a decline in electricity rates due to a fall in the costs of the fuel used in electricity generation. Also, transport-related expenses fell by 1.9% also related to lower oil prices.”

Looking ahead, Mr. Byles stated, “the Bank of Jamaica expects that consumer prices will rise at an average 12-month rate of about 4.5% over the next eight quarters. This outlook for inflation is based on the Bank’s expectations for the pass-through of Bank of Jamaica’s monetary accommodations to prices. It should be noted that the impact of this is expected to be partially offset by low global growth and inflation among Jamaica’s main trading partners, decline in international commodity prices as well as continued tight fiscal policy.”

Risks to the Forecast

The Bank assessed the risks to the inflation forecast to be generally balanced over the next two years but however outlined the downside and upside risk that would cause inflation to deviate from projections.

Downside Risks

The main downside risk that would result in inflation being lower than forecasted includes:

- Higher than anticipated production in the agricultural sector, leading to lower rates of increases in food prices.

Upside Risks

The main upside risk that would result in inflation being higher than forecasted are as follows:

- Depreciation in the exchange rate

- Stronger than anticipated domestic demand, driven by the improved credit conditions in the economy.

Recent Development in the Foreign Exchange Market

“Between October 01, 2019 and November 12, 2019, despite normal daily inflows, the exchange rate depreciated by 5.2% or J$7.07. This movement entirely reversed the appreciation of 1.8% that occurred in September 2019 and erased the sense of normal two-way movement in the exchange rate that has been evident for an extended period prior to October 2019. One of the factors influencing the spike in demand for foreign currency was the heightened demand relating to portfolio transactions, combined with seasonal re-stocking by retailers ahead of the Christmas period. In response to this unusual heightened demand, the Bank of Jamaica acted to enhance US dollar supply by selling a total of US$140M between October 18, 2019 and November 14, 2019 via five B-FXITT flash sale operations,” as mentioned by the Governor.

Furthermore, the Governor went on to state further that, “in our latest intervention on November 14, the Bank amended its rules to require all the funds sold by the Bank to Authorized dealers and large Cambios be re-sold to end-users (that is, non-financial commercial entities that are funding obligations for goods and services acquired).”

Nonetheless, Mr. Byles stated, “the Jamaican Government remains committed to maintaining a flexible exchange rate system. The Bank of Jamaica will therefore continue to ensure orderly conditions in the foreign exchange market and will intervene if there is excessive volatility or the emergence of temporary gaps in supply.”

In concluding, the Governor acknowledged, “the Jamaican economy could grow at a faster pace without it resulting in inflation increasing above the Bank’s target. As such, the Bank of Jamaica will continue to closely monitor the impact of monetary policy actions on credit expansion, capital market transactions, overall economic activity and consequently, the impact on inflation, to determine the appropriate future path for the policy rate.”

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.