October 14, 2020

Since the onset of the COVID-19 crisis, governments have focused on doing whatever it takes to limit its consequences. Public health measures that have contained the spread of the virus have helped restore confidence and created the conditions for the safe reopening of businesses. Unemployment benefits and wages subsidies have helped preserve jobs or living standards. Cash transfers have been especially useful to support the poor and informal workers and self-employed who lost jobs. Liquidity support to firms has prevented a wave of defaults and mass layoffs. This is especially important for small-and-medium-sized firms that represent a large share of employment.

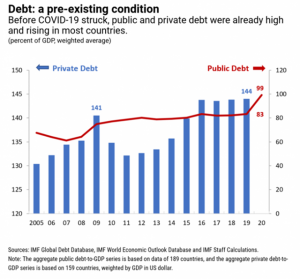

The unprecedented fiscal support provided since the start of the COVID-19 crisis has succeeded in protecting people and preserving jobs. However, responses by individual countries have been shaped by their access to borrowing as well as their public and private debt levels heading into the crisis.

In advanced and some emerging market economies, central bank purchases of government debt have helped keep interest rates at historic lows and supported government borrowing. In these economies, the fiscal response to the crisis has been massive. However in many highly indebted emerging market and low-income economies governments have had limited space to increase borrowing, which has hampered their ability to scale up support to those most affected by the crisis. These governments face tough choices.

A fiscal roadmap for the recovery

As economies cautiously reopen, but uncertainty about the course of the pandemic remains, governments should ensure that fiscal support is not withdrawn too rapidly. Instead, it should become more selective to avoid standing in the way of necessary sectoral reallocations as activity resumes. Support should shift gradually from protecting old jobs to getting people back to work and helping viable, but still-vulnerable firms safely reopen. With low-interest rates and high unemployment, boosting public investment—starting with maintenance and ramping up projects—can create jobs and spur economic growth.

Emerging market and low-income economies facing tight financing constraints will need to deliver more with less by reprioritizing spending and enhancing its efficiency. Some may need further official financial support and debt relief.

Governments should also adopt measures to improve tax compliance and consider higher taxes for more affluent groups and highly profitable firms. The ensuing revenues would help pay for critical services, such as health and social safety nets, during a crisis that has disproportionately hurt the poorer segments of society. Once the pandemic is under control, governments will need to foster the recovery while addressing the legacies of the crisis—including the large fiscal deficits and high public debt levels.

Looking ahead, countries will need to make it a priority to invest in healthcare systems and education. They should also strengthen social safety nets to ensure that all people have access to food and other basic goods and services. As economies begin to recover, governments should seize this moment to move away from the pre-crisis growth model and accelerate the transition to a low-carbon and digital economy. Carbon pricing should be a key feature of this transition, because it encourages people to reduce energy use and shift to cleaner alternatives, and it generates revenue that can be used in part to support the most vulnerable.

As governments increase their public investment and other fiscal measures to foster the recovery, their policy choices will have long-lasting effects. They should make a decisive push to make economies more inclusive and resilient, and to curb global warming through green measures that also boost growth and employment.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.