February 16, 2018

Interest income declined marginally by 6% during the three month period, amounting to $254.95 million relative to $270.27 million for the comparable period in 2016. Interest expense also declined to close at $174.17 million compared to $193.12 million in 2016. As a result, net interest income increased by 5% to $80.78 million relative to $77.16 million in 2016.

Dividend Income fell 33% to total $2.13 million compared to the $3.20 million earned for the first three months ended December 31, 2016. Gains on sale of investment fell by 34%, to $14.27 million (2016: $21.61 million), while Fees & Commissions Income rose by 11%, to close at $117.11 million (2016: $105.18 million).

Foreign exchange trading and translation amounted to a loss of $54.60 million compared to gain of $4.68 million recorded in the previous year.

Administrative Expenses for the period amounted to $77.82 million, increasing 15% from $67.76 million in 2016. Staff costs for the quarter rose 10% from $80.50 million book in 2016 to $88.57 million.

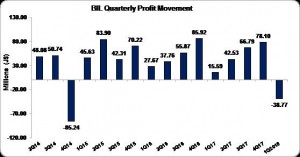

Notably, BIL reported zero Impairment of available-for-sale investment for the first quarter relative to $20 million in 2016. Profit before Taxation slid 112% to loss of $5.31million compared to a profit of $43.76 million the prior year.

Consequently, the company reported Net loss of $38.77 million, relative to the profit of $15.59 million booked in 2016; this followed taxation of $33.46 million (2016: $28.16 million).

Loss per Share for the first quarter ended December 31, 2017 totalled $(0.09) relative to an earnings per share of $0.03 in 2016. The trailing earnings per share amounted to $0.33. The number of shares used in our calculations amounted to 445,001,824 units. BIL stock price closed the trading period on February 15, 2018 at $8.45.

Balance Sheet at a glance:

As at December 30, 2017, total assets amounted $16.45 billion (2016: $15.31 billion), a $1.14 billion improvement as a result of the growth in “Pledged Assets” which increased by 87% to a total of $8.06 billion (2016: $4.31 billion).

Shareholders’ Equity amounted to $2.95 billion relative to $2.75 billion in 2016 resulting in a book value per share of $6.63 relative to $6.16 in 2016.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.