December 12, 2023

Blue Power Group Limited (BPOW) for the six months ended October 31, 2023, reported a 9% decrease in revenue totalling $402.06 million compared to $439.67 million in the corresponding period last year. Revenue for the second quarter had an 18% decrease to close at $185.73 million compared to $225.41 million for the comparable quarter of 2022.

Cost of sales amounted to $258.16 million (2022: $357.52 million), this represents a decrease of 28% year over year. Consequently, gross profit increased by 75% to $143.91 million compared to $82.15 million for the six months ended October 31, 2022. The Company booked gross profit of $71.20 million for the second quarter versus $37.88 million reported for the similar quarter of 2022.

Impairment losses on investment decreased by 41% to close at $451,343 (2022: $761,958), while impairment gains on trade receivables amounted to $437,958 versus impairment losses on trade receivables of $726,216 for the same period last year. Administrative and other expenses increased by 6% from $90.27 million in 2022 to $95.35 million in the period under review.

Other income for the six months ended October 31, 2023, amounted to $9.41 million, a 41% decrease relative to $15.85 million reported in 2022. Other income for the second quarter amounted to $4.47 million (2022: $5.35 million).

Consequently, profit from operations for the six months ended October 31, 2023, amounted to $57.96 million, an 829% increase relative to $6.24 million reported in 2022.

Finance income totalled $19.87 million, a 281% increase from the corresponding period last year (2022: $5.22 million). Finance income for the second quarter amounted to $9.98 million (2022: $4.70 million). Finance costs for the six months ended October 31, 2023, amounted to $2.08 million, a 23% increase relative to $1.69 million reported in 2022. Finance costs for the second quarter amounted to $958,731 (2022: $890,725).

Profit before taxation for the six months ended October 31, 2023, had a 298% increase to reach $90.01 million (2022: $22.64 million). Taxation for the six months amounted to $19.48 million, a 212% increase from the $6.24 million reported in 2022. For the second quarter, taxation was $9.33 million (2022: $4.86 million).

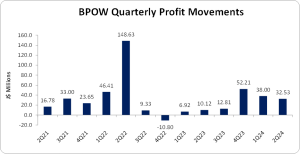

Net profit increased by 330% to $70.53 million (2022: $16.39 million). Net profit for the quarter totalled $32.53 million relative to the $10.12 million booked in the prior year’s quarter. Management noted that “the improved profits reflect the combined effect of (a) a range of initiatives to improve plant productivity and labour productivity, (b) improved procurement conditions and logistics costs, and (c) a change in the sales mix, to focus our production capacity on higher margin products.”

Comprehensive income for the period totalled $70.53 million, relative to the $16.39 million reported twelve months prior. For the quarter, comprehensive income amounted to $32.53 million compared to the $10.12 million reported in 2022.

Earnings per share (EPS) for the six months amounted to $0.12 (2022: $0.03), while EPS for the quarter totalled $0.06 (2022: $0.02). The twelve-month trailing EPS was $0.24, and the number of shares used in these calculations was 564,990,000.

Notably, BPOW’s stock price closed the trading period on December 11, 2023, at a price of $3.07 with a corresponding P/E ratio of 12.80x.

Management noted that: “Blue Power benefitted from its initiative to develop and maintain strategic long term customer relationships with some of the leading soap brands and distribution enterprises in Jamaica. Blue Power Group has made investments in plant and equipment to improve its competitiveness and to support these relationships with enhanced reliability and increased capacity to produce a wide range of high quality and specialty soaps. This resulted in improved gross margins.”

It was further noted: “During the quarter we continued to complete capital projects and make improvements to our quality systems, efficiency, facilities, and product lines. We note that some market opportunities within CARICOM may be constrained by current legal uncertainties about the trade rules within the region. We do, however, remain hopeful that Blue Power Group will be able to grow in the years ahead by manufacturing and co-packing bar soaps for both domestic and export markets.”

Balance Sheet Highlights:

The company’s assets totalled $1.64 billion; a 4% increase from the $1.57 billion booked in 2022. This upward movement follows a 938% increase in cash and cash equivalents, which amounted to $192.12 million (2022: $18.52 million).

Shareholder’s equity was $1.55 billion (2022: $1.43 billion), representing a book value per share of $2.74 (2022: $2.54).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.