July 28, 2022

Caribbean Assurance Brokers (CABROKERS) revenue for the six months ended June-30-2022 increased by 18% to $178.32 million (2021: $151.29 million). Revenue for the quarter increased by 15% to $87.72 million (2021: $76.21 million). Management noted that “the International, Individual Life, General and Employee Benefits Divisions all saw increases of 40%, 21%, 17% and 4% respectively over their prior year comparative performance. This upward movement was mainly attributable to a combined increase in new business activities.”

Other Operating Income for the six months ended June-30-2022 increased by 4% to $17.40 million (2021: $16.75 million). Other Operating Income for the quarter decreased by 16% to $3.78 million (2021: $4.49 million).

Total Operating Income for the six months ended June-30-2022 increased by 16% to $195.72 million (2021: $168.04 million). Total Operating Income for the quarter increased by 13% to $91.50 million (2021: $80.71 million).

Total operating expenses for the six months ended June-30-2022 increased by 1% to $188.41 million (2021: $186.23 million). Total operating expenses for the quarter decreased by 6% to $87.71 million (2021: $92.94 million). “Areas that contributed to the increases in expenses included staff costs, product development initiatives, repairs and maintenance, registration fees arising from increased license and regulatory fees and depreciation on additions to property, plant and equipment.”

Operating Profit for the six months ended June-30-2022 closed at $7.30 million versus operating loss of $18.18 million in the prior comparable period. Operating Profit for the quarter amounted to $3.78 million relative to an operating loss of $12.23 million booked twelve months prior.

Finance Costs for the six months ended June-30-2022 decreased by 31% to $2.06 million (2021: $2.98 million). Finance Costs for the quarter decreased by 34% to $991,703 (2021: $1.50 million). Management noted that the reduction “was attributable to a paydown on principal of mortgage denominated in foreign currency as well as a reduction in interest expense on lease liability.”

Taxation for the six months ended June-30-2022 increased by 437% to $790,166 (2021: $147,073). Taxation for the quarter decreased by 151% to $155,246 (2021: tax credit of $301,679). Management noted that “this is reflective of movement in deferred tax charges for the current quarter as there were additions to property, plant and equipment.”

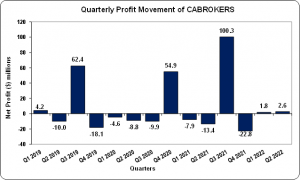

Net Profit for the six months ended June-30-2022 closed at $4.45 million versus net loss of $21.32 million documented twelve months earlier. Management noted that “this represents an increase of 121% over the prior comparative period reflecting the company’s performance as consumer activities continue to increase.” Net Profit for the quarter totalled $2.63 million (2021: net loss of $13.43 million).

EPS for the six months ended June-30-2022 closed at $0.02 (2021: LPS of $0.08). EPS for the quarter totalled $0.01 (2021: LPS of $0.05 ). The twelve months trailing EPS amounted to $0.31. The total number of shares used in the computation amounted to 262,500,000 units. Notably, CABROKERS closed the trading period on July 28, 2022 at a price of $2.26 with a corresponding P/E of 7.24 times.

Balance Sheet Highlights:

Total Assets for the six months ended June-30-2022 increased 8% to $760.28 million (2021: $702.27 million). Management noted that “the increase in assets was primarily due to a $78 million or 34% increase in receivables. There was a combined $20 million reduction in property, plant and equipment, deferred tax asset, right of use asset as well as cash and cash equivalents over the corresponding period.”

Total Equity for the six months ended June-30-2022 increased 25% to $389.62 million (2021: $311.08 million). Book Value Per Share for the period is $1.48 compared to the prior period $1.19.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.