Caribbean Flavours & Fragrances Limited (CFF)

For the financial year ended June 30, 2016

- Revenue for the 2017 financial year increased by 13% to $410.64 million relative to the 2016 figure of $362.50 million in 2016. For the quarter the company saw a 14% increase totaling $109.96 million (2016: $96.39 million).

- Cost of sales also increased in the 2017 financial year to $242.69 million. This compares to the prior year’s figure of $227.81 million representing an increase of 7%.

- As a result, gross profit increased by 25% to $167.94 million for the year in review. This compares to the prior year’s amount of $134.70 million.

- The company had an 32% year on year increase in total expenses to $95.01million up from $72.20 million in 2016. This was attributed to a 32% increase in administration expenses to $88.69 million (2016: $67.18 million) and a 26% increase in expenses associated with selling and distribution to $6.33 million (2016: $5.01 million).

- Consequently, profit from operations for the 2017 year increased to $72.93 million from the prior year’s figure of $62.50 million representing a 17% increase. The company saw a decrease in finance income from $11.57 million in 2016 to $10.78 million in 2017. Finance cost for the period amounted to $830,000 relative to nil for the prior year.

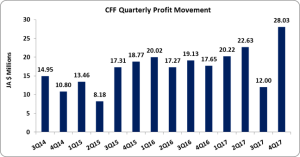

- As a result, net profit for the year amounted to $82.88 million representing a 12% increase from the 2016 year end figure of $74.07 million. Net Profit for the quarter saw a 59% increase totaling $28.03 million relative to $17.65 million 2016. According to the company “The continuous positive growth in net profits was driven by our ability to manage our operational expenses whilst growing revenue at a double-digit rate.”

- The earnings per share (EPS) for the financial year amounted to $0.92 versus $0.82 booked in 2016. The EPS for the quarter amounted to $0.31 relative to $0.20 reported for the corresponding period last year. The number of shares used in this calculation was 89,920,033 units.

- The company stated that, “A deliberate strategy to maintain sufficient inventory levels in order to better satisfy our customer’s requirements has allowed the Company to grow its revenues and profits. The securing of new markets for fragrances and increasing the volume of sales of flavours to existing customers and new customers in foreign markets has also contributed significantly in this regard.”

Balance Sheet Highlights:

- The company, as at June 30, 2017, recorded total assets of $376.11 million, an increase of 27% when compared to $296.09 million for the 2016 financial year. The company increased its Plant and Equipment to $14,915 million relative to the $3 million reported in 2016. Total inventories also increased within the year to $97.22 million relative to $71.75 million the prior year. Receivables also contributed to the increase moving from $39.45 million in 2016 to $60.12 million.

- Total Stockholders’ equity as at June 30, 2017 closed at $330.57 million, an improvement 20% from $276.35 million last year. This resulted in a book value per share of $3.68 compared to a value of $3.07 for the prior year.