Date: November 15, 2019

Caribbean Flavours and Fragrances, for the nine months ended September 30, 2019, reported revenues of $358.44 million (2018: $329.57 million). For the quarter, revenue amounted to $132.11 million, an increase of 10%, when compared with the $120.14 million booked last year. CFF noted, “this was driven by seasonal demands from our customers but we expect to see improvements in sales in the upcoming final quarter of this financial year.” The Company also noted, “sales continue to be trending in the right direction despite lower than anticipated sales of some new products. Our sugar reduction solution has not achieved full acceptance as anticipated, partly due to a lack of enforcement.”

Cost of sales amounted to $233.70 million (2018: $200.50 million), this resulted in gross profit decreasing by 3%, to $124.74 million in 2019, relative to $129.07 million booked last year. Gross profit for the quarter closed at $40.24 million (2018: $44.59 million). According to management, “fluctuations in the foreign exchange rates as well as increased logistics costs during this quarter to expedite customers’ urgent requests negatively impacted our gross profit.”

Administrative expenses increased by 21% to close the period under review at $76.21 million (2018: $63.11 million); whereas, selling and distribution costs totalled $1.31 million (2018: $3.74 million). While for the quarter, aadministrative expenses increased 15% to $27.17 million (2018: $23.58 million), while selling and distribution costs decreased to $618,000 for 2019 (2018: $758,000). Also, Finance income closed the period at $7.97 million relative to $7.80 million the in 2018.

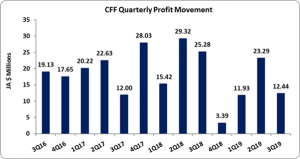

Profit before taxation totalled $55.19 million compared to $70.02 million in the prior year. For the quarter, profit before taxation amounted to $14.95 million (2018: $25.28 million), a decrease of 41%. Taxation of $7.54 million was booked for the period under review (2018: nil), resulting in net profit of $47.66 million versus net profit of $70.02 million in 2018. However, for the quarter, net profit closed at $12.44 million (2018: $25.28 million). The Company noted, “this reduction in profit is expected given the additional costs incurred which are aligned to the future growth prospects of the Company.”

In addition, the Company stated, “Caribbean Flavours and Fragrances continue to work to ensure that we become a more solution driven organization as we seek to explore and gain more acceptance in new markets such as Cuba as well as deepening our presence in many of the other local and overseas markets. Given the levels of investments and interest we expect that this will translate to positive financial benefits in the short to medium term.”

Earnings per share for the period amounted to $0.53 (2018: $0.78). While, for the quarter, EPS totalled $0.14 (2018: $0.28). The twelve months trailing EPS is $0.57. The number of shares used in the calculation was 89,920,033 units. CFF closed the trading period on November 14, 2019 at a price of $14.50.

According to CFF, “we will continue with the refinement of our export strategies and other improvements to our various cost structures in order to drive the desired efficiency whilst improving our cost of sales and gross profit.”

Balance Sheet at a glance:

As at September 30, 2019, Total Assets amounted to $521.22 million, $59.43 million more than its balance of $461.79 million a year prior. This increase was driven by a 8% or 15.72 million increase in ‘short term investments’ to total $212.54 million (2018:$ 196.83 million). Also, ‘Inventories’ and ‘Receivables and Payments’ contributed to the increase closing at $153.30 million (2018: $131.56 million) and $105.30 million (2018: $80.15 million), respectively.

Shareholders’ Equity totalled $455.16 million (2018: $423.76 million) with a book value of $5.06 (2018: $4.71).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.