Date: May 15, 2019

Dolphin Cove (DCOVE) for the three months ended March 31, 2019 reported total revenue of US$3.89 million, a 3% increase when compared to US$3.79 million booked the year prior. Revenue from Dolphin Attraction contributed US$2.20 million to total revenue; this represents a 2% decline when compared to the US$2.24 million reported in the prior year. Revenues from the Ancillary Services totalled US$1.69 million, a 9% increase from last year’s US$1.55 million. According to the company “During the first three months of the year we saw a slight recovery in the Tour Operator market (+2%), particularly for the Montego Bay park. Cruise ship arrivals to the Falmouth Port declined by 24%, which is significant since 50% of our guests from cruise ships comes from that port. Despite the decrease in sales from Cruise Ships, all the other Markets showed a good performance allowing us to achieve 3% increase in our revenue compared to Q1 2018.”

Total direct cost for the period totalled US$458,509 million, a 56% hike when compared to the US$294,425 reported in 2018. Management noted, “as a result of the improvement in the quality of our products at all our parks and stronger promotion through the different marketing channels. Our operation is now more expensive as we have to be one step ahead of our competitors. Dolphin Cove continues to offer a high-level product for our guests, and all the renovations and added values implemented during 2018 were meant to get better results this year.”

As such, gross profit for the period went down by 2%, amounting to US$3.43 million relative to 2018’s total of US$3.50 million.

Other income increased 8% to US$66,256 million relative to US$61,322 booked in 2018.

Total Operating Expenses advanced 6% moving from US$2.38 million in 2018 to US$2.51 million. Of this, administrative expenses totalled US$670,209 (2018: US$549,194) while Selling Expenses amounted to $1.03 million (2018: US$950,671). Other operating expenses for the period declined 7% to US$816,373 (2018: US$876,446)

Finance income declined by 86%, totalling US$8,923 relative to US$64,124 last year while finance cost moved down from US$74,942 for the same period in 2018 to US$69,348.

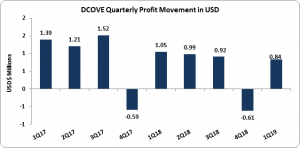

Profit before Taxation saw a decline of 21% to US$927,728 from US$1.17 million.

Following taxation of US$84,926 (2018: US$125,860), Net Profit for the period was US$842,802, 19% less than the US$1.05 million charged the prior year.

Earnings per stock unit for the three months totalled US$0.0021 relative to US$0.0027 in 2018. The trailing twelve-month EPS amounted to U$0.005. The stock traded at JMD$12.01 as at May 15, 2019. The number of shares used in the calculation was 392,426,376.

DCOVE highlighted that, “We are pleased to announce the opening of a new Dolphin park in Jamaica after more than 6 months of hard work and sustainability studies. On 6 of March we opened a new facility within the new Puerto Seco Beach Club at Discovery Bay and this new park will give us the opportunity to host our cruise ship guests in a location closer to the port of Falmouth.”

Balance sheet Highlights :-

As at March 31, 2019, the company’s assets totalled US$32.84 million, 11% more than the US$25.97 million reported as at March 31, 2018. The was as a result of 8% increase in ‘Property, Plant and Equipment’ to US$22.65 million relative to US$20.96 million booked in 2018. The company further added, “ Working Capital increased by 56% as a result of the renovation works and improvements to fixed assets and the reduction of our current liabilities as well as maintaining the level of dividends at a time of reduced profits, but it is at the very healthy ratio of over 01:1.”

The company closed the financial period with shareholders’ equity in the amount of US$29.69 million (2018: US$26.88 million) which resulted in book value per share of US$0.076 (2018: US$0.068).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.