February 16, 2021

Expressed in Barbados dollars

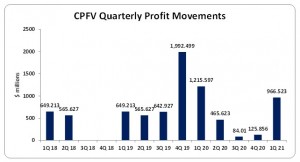

Eppley Caribbean Property Fund Limited (CPFV), for the three months ended December 31, 2020 reported net rental income of $936,220 (2019: $843,396), a 11% increase year over year. In addition, share of profit of investments accounted for using the equity method decreased from $544,688 in 2019 to $417,430 for the three months ended December 2020.

Interest income amounted to $201,860 versus $269,745 booked for the corresponding three months last year.

As such, total investment income decreased to a total of $1.56 million (2019: $1.66 million).

Total operating expenses amounted to $588,987 (2019: $442,631). Total operating expenses can be broken down as follows:

Interest expenses totalled $153,333 (2019: $121,856).

Fund management fees was $175,935 compared to $165,800 booked twelve months earlier.

Professional fees totalled $76,187 (2019: $54,654).

Directors and subcommittee fees closed at $830 (2019: $800).

Office and administrative fees went down to $3,257 (2019: $6,487).

Investment advisor fees totalled $175,935 (2019: $165,800).

Profit before tax and also net profit for the three months ended December 31, 2020 closed at $966,523 (2019: $1.22 million).

Profits attributable to Cellular property fund shareholders for the three months amounted to $966,523 compared to $1.22 million booked prior corresponding period.

Consequently, total comprehensive income for the period closed at $966,831 compared to $1.15 million reported for 2019’s corresponding period.

Earnings per share for the three months ended December 31, 2020 totalled 0.7068 cents compared to EPS of 0.8890 cents for the corresponding period in 2019. The twelve months trailing EPS amounted to 1.201 cents. The total amount of shares outstanding used for this calculation was 136,742,547 units. CPFV closed the trading period at J$41.50 on February 15, 2020 with a corresponding P/E of 34.56 times.

CPFV noted, “Our Jamaican properties, together with our recently acquired industrial and office assets have allowed the Fund to mitigate the adverse effects of the pandemic on our Barbados retail properties, some of which are directly impacted by the slowdown in the global travel industry.”

Additionally, “last quarter, the Fund successfully acquired controlling stakes in two landmark Jamaican assets, namely 693 Spanish Town Road and Mall Plaza. 693 Spanish Town Road is a 3-acre industrial property, consisting of over 75,000 square feet of warehouse and office space in Kingston’s industrial belt. The full benefits of this acquisition are yet to be reflected in our financials. However, in the upcoming months, this property should add significant cashflow and provide further scale and diversification.”

Balance sheet at a glance:

As at December 31, 2020, total assets amounted to $116.08 million, 14% more than prior corresponding period’s $101.77 million in 2019. This was attributed to a rise in ‘Investment properties’ which closed the period at $63.22 million (2019: $48.76 million). Also, the growth in ‘Investment in associated companies and joint arrangements’ contributed the company’s assets, closing at $31.21 million (2019: $21.78 million).

CPFV, as at December 31, 2020, booked total shareholders’ funds of $95.66 million (2019: $86.43 million), which translated into a net asset value per share of $0.70 (2019: $0.63).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.