August 16, 2021

Reported in Barbados Dollars unless otherwise indicated:

Eppley Caribbean Property Fund Limited (CPFV), for the nine months ended June 30, 2021 reported net rental income of $2.98 million (2020: $2.15 million), a 38% increase year over year. In addition, share of profit of investments accounted for using the equity method decreased from $1.17 million in 2020 to $1.42 million for the nine months ended June 2021.

Fair value gains on investment property amounted to $136,296 relative to a loss of $220,477 in 2020.

Interest income amounted to $513,372 versus $582,716 booked for the corresponding nine months last year. Other income of $2,072 was reported for the nine months ended June 2021 (2020: $423).

As such, total investment income increased to a total of $5.05 million (2020: $3.69 million). For the third quarter ended June 30, 2021, total investment income amounted to $1.79 million (2020: $766,446).

Total operating expenses amounted to $2.29 million (2020: $1.92 million). Total operating expenses can be broken down as follows:

Interest expenses totalled $692,260 (2020: $367,701).

Fund management fees rose 10% to $540,214 compared to $490,962 booked for 2020 nine months.

Professional fees totalled $307,723 (2020: $256,409).

Directors and subcommittee fees increased 4% to close at $2,490 (2020: $2,400).

Office and administrative fees declined to $14,943 versus $25,730 reported in 2020.

Impairment charge closed the nine months at $6,517 relative to an impairment gain of $24,221 in 2020.

Investment advisor fees totalled $540,214 (2020: $490,962).

Total operating expense for the third quarter ended June 30, 2021 amounted to $772,103 (2020: $682,437).

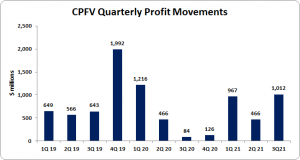

Profit before tax for the nine months ended June 30, 2021 closed at $2.76 million (2020: $1.76 million). Whereas, profit before tax for the third quarter ended June 30, 2021 totalled $1.02 million (2020: $84,009).

Profits attributable to Cellular property fund shareholders for the nine months amounted to $2.64 million compared to $1.77 million booked prior corresponding period. While, profit attributable to Cellular property fund shareholders for the third quarter ended June 30, 2021 totalled $1.01 million (2020: $84,009).

Consequently, total comprehensive income for the period closed at $2.42 million compared to $1.90 million reported for 2020’s corresponding period. Total comprehensive income for the third quarter ended June 30, 2021 totalled $884,449 (2020: $206,276).

Earnings per share for the nine months ended June 30, 2021 totalled 1.93 cents compared to EPS of 1.29 cents for the corresponding period in 2020. The third quarter’s EPS amounted to 0.74 cent (2020: 0.06 cent). Trailing EPS amounted to 2.02 cents. The total amount of shares outstanding used for this calculation was 122,181,628 units. CPFV closed the trading period at JMD $41.16 on August 16, 2021.

The Company stated, “, the increase is largely reflective of added income generated from recent acquisitions and strategic management of the Fund’s operational efficiency.”

CPFV noted, “Funds From Operations (FFO) attributable to shareholders, a metric that reflects the Fund’s NOI less its net cost of financing, increased 19% to $2.7 million. As the operating environment improves and the Fund realizes the full benefit of recent acquisitions in Jamaica and Trinidad & Tobago, we expect to deliver continued growth in (FFO) attributable to shareholders over time. In line with our core strategy, the Fund recently completed the acquisition of two high-quality commercial properties in Trinidad & Tobago. Following the acquisitions, the Value Fund’s geographic footprint now spans across three of the largest English-speaking countries in the Caribbean, being Jamaica, Barbados and Trinidad & Tobago.”

Balance Sheet Highlights:

As at June 30, 2021, total assets amounted to $126.91 million, 28% more than prior corresponding period’s $99.05 million in 2020. This was attributed to a rise in ‘Investment properties’ which closed the period at $71.20 million (2020: $48.06 million). This was offset by a decrease in ‘Cash and Cash Equivalents’ which closed at $17.85 million (2020: $28.60 million).

CPFV, as at June 30, 2021, booked total shareholders’ funds of $95.90 million (2020: $86.71 million), which translated into a net asset value per share of $0.70 (2020: $0.63).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.