May 16, 2022

Reported in Barbados Dollars unless otherwise indicated:

Eppley Caribbean Property Fund Limited (CPFV), for the six months ended March 31, 2022 reported net rental income of $2.26 million (2021: $1.90 million), a 19% increase year over year. In addition, share of profit of investments accounted for using the equity method increased from $864,320 in 2021 to $2.09 million for the six months ended March 31, 2022.

Fair value gains on investment property amounted to $1.12 million relative to a gain of $136,298 in 2021.

Interest income amounted to $339,476 versus $355,830 booked for the corresponding six months last year. Other income of $572 was reported for the six months ended March 31, 2022 (2021: $1,000).

As such, total investment income increased to a total of $5.81 million (2021: $3.26 million). For the third quarter ended March 31, 2022, total investment income amounted to $3.96 million (2021: $1.86 million).

Total operating expenses amounted to $1.67 million (2021: $1.52 million). Total operating expenses can be broken down as follows:

- Interest expenses totalled $664,422 (2021: $373,333).

- Fund management fees rose 4% to $374,705 compared to $359,469 booked for 2021 six months.

- Professional fees totalled $208,049 (2021: $220,375), reflecting a 6% year over year decline.

- Directors and subcommittee fees increased 1% to close at $1,680 (2021: $1,660).

- Office and administrative fees declined to $7,141 versus $8,218 reported in 2021.

- There was no impairment charge for the six months relative to an impairment charge of $2,912 in 2021.

- Net foreign exchange loss declined to $37,219 (2021: $192,611)

- Investment advisor fees totalled $374,705 (2021: $359,469).

Total operating expense for the third quarter ended March 31, 2022 amounted to $952,666 (2021: $1.28 million).

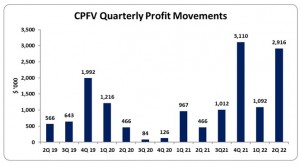

Profit before tax for the six months ended March 31, 2022 closed at $4.14 million (2021: $1.74 million). Whereas, profit before tax for the third quarter ended March 31, 2022 totalled $3.01 million (2021: $580,999).

Following a tax charge of $112,014 (2021: $115,107), net profit for the period amounted to $4.03 million (2021: $1.62 million). CPFV noted, “the strength of our operations and quality of our underlying assets continue to drive consistent growth in performance, further validating key strategic initiatives executed by management in recent years.”

Profits attributable to Cellular property fund shareholders for the six months amounted to $4.03 million compared to $1.62 million booked prior corresponding period. While, profit attributable to Cellular property fund shareholders for the third quarter ended March 31, 2022 totalled $2.92 million (2021: $465,892).

Consequently, total comprehensive income for the period closed at $1.62 million compared to $1.54 million reported for 2021’s corresponding period. Total comprehensive income for the third quarter ended March 31, 2022 totalled $2.80 million (2021: $377,571).

Earnings per share for the six months ended March 31, 2022 totalled 2.95 cents compared to EPS of 1.19 cents for the corresponding period in 2021. The third quarter’s EPS amounted to 2.14 cents (2021: 0.34 cents). Trailing EPS amounted to 5.98 cents. The total amount of shares outstanding used for this calculation was 122,181,628 units. CPFV closed the trading period at J$47.50 on May 13, 2022 with a corresponding P/E of 10.37 times.

Management noted, “in line with our core strategy to scale and diversify, the Fund, in partnership with JMMB Fund Managers, successfully completed the acquisition of 22 Chalmers Avenue, a 99,000 square foot purpose built BPO facility in Kingston, Jamaica.” Furthermore, “22 Chalmers Avenue is the new Kingston campus of itel and will house approximately 1,400 BPO seats. This acquisition was concluded near the end of the financial quarter and as a result, the financials are yet to reflect the full benefits of this acquisition.”

Balance Sheet Highlights:

As at March 31, 2022, total assets amounted to $126.82 million, 9% more than prior corresponding period’s $116.42 million in 2021. This was attributed to a rise in ‘Investment properties’ which closed the period at $73.16 million (2021: $62.40 million).

CPFV, as at March 31, 2022, booked total shareholders’ funds of $100.04 million (2021: $96.18 million), which translated into a net asset value per share of $0.73 (2021: $0.71).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.