Date: May 15, 2019

Expressed in United States dollars (except where it is indicated otherwise)

Caribbean Producers Jamaica Limited (CPJ) for the nine months ended March 31, 2019 revenues grew marginally by 0.1% from $81.65 million, to close the period at $81.74 million compared to the prior year. For the third quarter, the company posted a 1% growth in revenues to close at $28.01 million relative to $27.74 million for the same quarter of 2018. CPJ noted that, “the growth in the revenues and the return to profitability in Q3, has resulted in an improved performance over the two periods. This is a strong indicator that the company is recovering from business disruption it experienced from the failed IT project in the first half of the current fiscal year.” The Company also noted it witnessed “strong demand for its diversified portfolio of products in this quarter, and hence its Spirits sales grew by 28%, Seafood sales by 11%, Dairy by 6%, Frozen grocery by 8%, Juices by 12% and RTD beverages by 8% when compared to the nine-month period last year.”

Cost of goods sold showed a 2% increase closing the period at $60.83 million relative to 59.37 million for the corresponding period in 2018. For the quarter, the company recorded a 4% increase in cost of goods sold to close at $20.57 million relative to $19.85 million for the comparable period in 2018.

Consequently, CPJ recorded a 6% decline in gross profits to $20.90 million for the nine months (2018: $22.28 million). Gross profits for the quarter also declined 6% to $7.44 million relative to $7.89 million in 2018.

Selling and administrative expenses were $17.82 million, a 9% increase on the $16.34 million posted for the prior year while Depreciation fell by 0.4% closing the period at $1.85 million (2018: $1.86 million).

Other operating income totaled $172,883; this compares with an operating income of $72,894 booked in 2018. The Company also booked ‘Intangible asset written-off of $610,008 for the period relative to nil the prior year.

Profit before finance costs, income and taxation declined 89% to total $452,123 relative to $4.15 million in 2018.

Finance costs amounted to $1.33 million (2018: $1.36 million) while Finance income decreased by 10% to close at $288 (2018: $320). As such loss before taxation was $876,424 compared to a profit of $2.79 million in 2018.

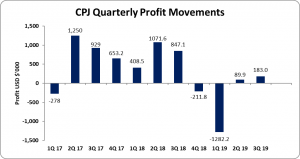

Following taxation of $105,791 (2018: $249,234), Net loss for the nine months amounted to $982,215 relative to 2018’s net profit of $2.54 million, while for the quarter, net profit amounted to $150,419 relative to a net profit $918,728 booked last year, a 84% decline.

Net loss attributable to shareholders for the nine months amounted to $1.01 million relative to a profit of $2.31 million recorded the prior year. Net profit attributable to shareholders for the quarter amounted to $183,012 (2018: $847,119)

As a result, loss per share (EPS) for the nine months amounted to US0.092 cents compared to an earnings per share of US0.21 cents in 2018. EPS for the quarter amounted to US$.02 cents relative to US$0.08 cents for 2018. The trailing twelve month EPS amounted to US0.11 cents. The number of shares used in our calculations amounted to 1,100,000,000 units. CPJ closed trading on May 15, 2019 at J$4.85

CPJ stated, “The Group reflected a nine-month net loss of US$0.98 M. The loss was mainly due to the following: Impairment of an intangible IT software of US$0.61M as a result of the failed implantation of a new Warehouse Management System and Correlated impact on Supply chain and Logistics expenses”

Balance Sheet Highlights:

As at March 31, 2019 CPJ’s total assets amounted to $64.87 million, a 7% increase from the $60.60 million booked in 2018. The growth year over year was linked to upward movements in Property, Plant and Equipment (17%) and Inventories (16%). Property, Plant and Equipment and Inventories as at March 2019 amounted to US$13.81 million (2018: US$11.82 million) and US$30.08 million (2017: US$25.88 million) respectively.

Shareholder’s Equity totaled $22.50 million (2017: $23.72 million) resulting in a book value per share of approximately US2.05 cents (2018: US2.16 cents).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.