February 9, 2022

Figures are quoted in United States dollars (except where it is indicated otherwise):

Caribbean Producers Jamaica Limited (CPJ) for the six months ended December 31, 2021, revenues rose 138% from $24.39 million in 2020 to close the period under review at $58.08 million. For the second quarter, the company also posted a 120% increase in revenues to close at $33.06 million relative to $15.05 million for the same quarter of 2020. CPJ noted that, “the increase in revenues during the last six months can be attributed to continued confidence in the Company, and a sustained rebound in the Hospitality sector. CPJ continues to make strides both in the Retail and Hospitality channels, with increased revenues in Q2.”

Cost of operating revenue also showed a 118% increase closing the period at $39.33 million relative to $18.02 million for the corresponding period in 2020. For the quarter, the company recorded a 102% increase in cost of operating revenue to close at $22.45 million relative to $11.10 million for the comparable period in 2020.

Consequently, CPJ recorded an increase in gross profits to $18.75 million (2020: $6.37 million). Gross profits for the quarter also increased from $3.94 million in 2020 to $10.61 million in 2021.

Selling and administrative expenses were $9.49 million, a 53% increase on the $6.19 million posted for the prior year. Depreciation for the period rose marginally by 1% closing the period at $2.14 million (2020: $2.12 million). Expected Credit Losses amounted to $98,032 (2020: $111,000). The Company noted that, “Management continues to proactively engage in cost containment activities whilst implementing measures to enhance operating efficiencies to increase sales, market share and profitability.”

Other operating income totaled $557,864; this compares with operating income of $132,623 booked in 2020.

The company booked a profit before finance costs, income and taxation of $7.59 million relative to a loss of $1.91 million in 2020.

Finance costs amounted to $1.50 million (2020: $894,390). Finance income closed at $4,523 (2020: $16,235). As such profit before taxation was $6.10 million compared to a loss of $2.79 million in 2020.

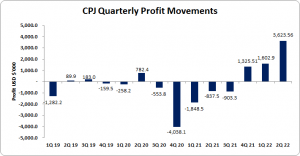

After taxation charge of $679,568 (2020: nil), net profit for the six months amounted to $5.42 million relative to a loss of $2.79 million in 2020. While for the quarter, net profit amounted to $3.75 million relative to a net loss $850,371 booked last year.

Net profit attributable to shareholders for the six months amounted to $5.23 million relative to a loss of $2.69 million in 2020. While for the quarter, net loss attributable to shareholders amounted to $3.62 million relative to a net loss attributable to shareholders of $837,492 booked last year.

As a result, earnings per share (EPS) for the six months amounted to US0.48 cent compared to loss per share (LPS) of US0.24 cent in 2020. EPS for the quarter amounted to US0.34 cent relative to LPS of US0.08 cents twelve months prior. The twelve months trailing earnings per share amounted to US0.51 cent (J$0.80). The number of shares used in our calculations amounted to 1,100,000,000 units. CPJ closed trading on February 09, 2022, at J$19.14 with 24.03 times.

CPJ stated, “Despite the increased risk presented by the new variants of the COVID virus, which has had some effect on the Hospitality industry, the CPJ Group remains optimistic for the second half of the financial year. Recent announcements of hotel room expansions in the Hospitality sector will only serve to propel the demand for CPJ products and services. The Group continues to expand its operations both onshore and offshore, with the commissioning of new stores, and continuation of the work being done to expand the Retail channel. We look forward to the opening of the CPJ Market Drax Hall outlet in late Summer of 2022. Our newly renovated and expanded CPJ Market in Montego Bay is nearing completion and will be opened before Easter of 2022. These two new stores will greatly improve the CPJ customer experience. Work will also commence shortly on enhancing the food service product line in CPJ Market in Kingston. As we accelerate the use of technology, we are excited to be launching our new B2B online platform. This new online portal will serve both our Retail and Hospitality customers, bringing a new level of experience to CPJ’s customers.”

Balance Sheet at a glance:

As at December 31, 2021, CPJ’s total assets amounted to $58.38 million, a 2% increase from the $57.10 million booked in 2020. The increase was mainly attributable to a 33% increase in ‘Inventories’ to $25.79 million (2020: $19.38 million) and a 73% increase in ‘Right Use of Asset’ to $11.70 million (2020: $6.78 million). This was however partially tempered by an 81% decrease in ‘Accounts Receivable’ which amounted to $2.17 million (2020: $11.65 million).

Shareholder’s Equity totaled $20.87 million (2020: $15.33 million) resulting in a book value per share of approximately US1.90 cents (2020: US1.39 cents).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.