Date: August 16, 2019

Dolphin Cove Limited (DCOVE), for the six months ended June 30, 2019 reported total revenue of US$7.85 million, a 2% increase when compared to US$7.73 million booked the year prior. Revenue from dolphin attraction contributed US$4.36 million to total revenue, a 3% improvement when compared to the US$4.24 million reported in 2018, while revenues from the ancillary services totalled US$3.48 million, a marginal decrease from last year’s US$3.49 million. Total revenue for the quarter amounted to US$3.95 million (2018: US$3.87 million), with Dolphin Attraction and Ancillary Service contributing US$2.16 million (2018: US$1.94 million) and US$1.79 million (2018: US$1.94 million) respectively. DCOVE noted, “Despite the decrease in sales from Cruise Ships, all the other distribution channels showed a good performance allowing us to achieve 1% increase in our revenue compared to Q2 2018.”

Direct costs of sales for the period totalled US$813,929, 24% more than the US$655,906 reported in 2018. As such, net revenue for the six months amounted to US$7.03 million (2018: US$7.07 million). DCOVE for the second quarter booked net revenue of US$3.60 million (2018:$3.51 million). DCOVE stated, “Our direct costs increased during the first half of the year due mainly to the addition of 4 dolphin as well as the direct costs related to the new facilities at Puerto Seco Beach Club which contributed to the increase in expenses, however, the main drivers for the increase in our expenditure were:

Salaries and Benefits – In 2018 due to the enhanced security measures implemented by the government, we decided to put on hold the hiring of some positions. When we considered that this situation stabilized at the end of 2018, we hired the additional staff to provide a better experience to our guests.

Selling and Marketing – The commercial areas have had a very active six months with increased promotion and advertising as a result of which we achieved an increase in the attendance by 8.2% compared to 2018.”

Other income for the period declined by 1% to US$129,548 compared to US$131,299 a year earlier.

Total operating expenses for the six month increased, moving to US$5.15 million in 2019 from US$4.80 million. Of this;

o Selling expenses increased by 15% to total US$2.10 million relative to US$1.83 million.

o Other operations totalled US$1.82 million, 7% more than US$1.69 million recorded the prior year.

o Administrative expenses dipped by 4% to total US$1.24 million compared to US$1.29 million in 2018.

Finance income increased by 162% totalling US$71,840 relative to US$27,456 last year. The company’s finance cost increased by 33% from US$142,366 for the same period in 2018 to US$188,757 in 2019.

Profit before tax fell by 17% to US$1.89 million from US$2.29 million. Tax charges for the period were US$166,106 (2018: US$250,811).

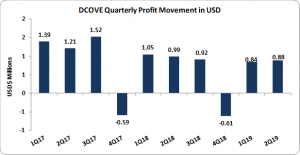

Profit for the period was US$1.73 million a 15% decline on the US$2.03 million booked the prior year. Profit for the second quarter also declined, moving from US$988,386 in 2018 to US$883,299 for the six months ended June 2019.

Earnings per stock unit for the six months totalled US$0.0044 (J$0.58) relative to US$0.0052 (J$0.68) in 2018, while EPS for the quarter amounted to US$0.0023 (J$0.30) relative to US$0.0025 (J$0.33) in 2018. The trailing twelve months EPS amounted to US$0.01(J$0.68). DCOVE’s stock last traded on August 15, 2019 at $12.05.

Balance sheet as at June 30, 2019:-

The company’s assets totalled US$33.15 million, 10% greater than the US$30.19 million reported as at June 30, 2018. This was as a result of a 8% increase ‘Property, plant and equipment’ and ‘Accounts receivable’ which closed the period at US$23.24 million (2018: US$21.50 million) and US$2.42 million (2018: US$1.41 million) respectively.

DCOVE highlighted, “Working Capital increased by 29% as a result of the renovation works and improvements to the physical assets, the reduction of the current portion of long-term debt and the increase in the accounts receivable driven by the business produced by the Tour Operators which have longer credit terms than the Cruise Lines.”

The company closed the financial period with shareholders’ equity in the amount of US$29.34 million (2018: US$27.27 million). The increase was due to a growth in capital reserves from US$10.55 million in 2018 to US$12.46 million in 2019. The company now has a book value per share of US$0.075 (2018: US$0.069).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.