January 15, 2024

Expressed in United States dollars unless otherwise stated:

Express Catering Limited (ECL) for the six months ended November 30, 2023, reported a 27% increase in Revenue totaling $11.58 million compared to $9.12 million in the corresponding period last year. Revenue for the second quarter had a 23% increase to close at $5.18 million compared to $4.20 million for the comparable quarter of 2022.

ECL noted the increase for the quarter, “was in part supported by the 8.1% increase in passenger count. 529,800 passengers accessed the departure lounge of the airport during the Quarter compared to 490,045 passengers for the similar period in the prior year. Passenger totals for the similar period in 2019 was 445,537.”

Additionally, “The increase in passenger count for the six months was 12.7%. The total passenger count was 1.25 million compared to 1.11 million for the similar period in the prior year. This generated revenue of US$11.58 million for a spend-per-passenger rate of US$9.24.”

Cost of Sales amounted to $3.83 million (2022: $3.25 million), this represents an increase of 18% year over year. Consequently, gross profit increased by 32% to $7.75 million compared to $5.86 million in 2022. The company booked gross profit of $3.45 million for the second quarter versus $2.69 million reported for the similar quarter of 2022.

Depreciation and amortization increased marginally to close at $1.357 million (2022: $1.356 million). Administrative Expenses increased by 60% from $2.48 million in 2022 to $3.97 million due to higher than usual amendment to the minimum wage rates. Total expenses for the six months amounted to $5.51 million, a 37% increase relative to $4.03 million reported in 2022.

Operating Profit for the six months amounted to $2.25 million, a 22% increase relative to $1.85 million reported in 2022. Operating Profit for the second quarter amounted to $846,457 (2022: $653,394). Finance Cost totalled $1.19 million, a 14% increase from the corresponding period last year. (2022: $1.04 million).

Foreign Exchange Loss for the six months amounted to $23,395, relative to a loss of $24,051 reported in 2022. Foreign Exchange Gain for the second quarter amounted to $1,237 (2022: Loss of $5,055).

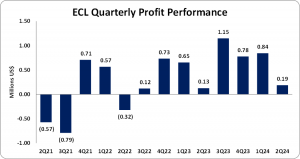

Profit before tax for the six months had a 32% increase to reach $1.03 million (2022: $779,649). Profit for the year being total comprehensive income for the six months amounted to $1.03 million, a 32% increase from the $779,649 reported in 2022. For the second quarter, Profit for the year being total comprehensive income was $187,240 (2022: $126,807).

Consequently, Earnings Per Share for the six months amounted to J$0.10 (2022: EPS: J$0.07), while Earnings Per Share for the quarter totaled J$0.02 (2022: EPS: J$0.01). The twelve-month trailing EPS was J$0.28 and the number of shares used in these calculations was 1,637,500,000.

Notably, ECL’s stock price closed the trading period on January 12, 2024, at a price of J$3.93 with a corresponding P/E ratio of 14.01x.

Balance Sheet Highlights

The company’s assets totalled $44.16 million (2022: $41.87 million). This resulted from a 28% increase in ‘Owing by related companies’ closing at $15.43 million.

Shareholder’s equity was $7.07 million (2022: $4.12 million), representing a book value per share of J$0.68 (2022: J$0.39).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.