August 18, 2020

Everything Fresh (EFRESH) for the six months ended June 30, 2020 reported total revenues of $573.21 million, a 49% decrease from the $1.11 billion reported for the prior period in 2019. For the quarter, revenue totalled $83.96 million, 84% less than the $520.54 million reported for 2019’s quarter. EFRESH stated, “The Covid-19 pandemic started to impact our sales in middle of March 2020, when our hotel customers began to close their properties. Most of these properties remained closed throughout our second quarter which ended 30 June 2020. Although Jamaica lifted travel restriction on June 15, we did not have any significant sales to hotels until July, after the second quarter ended.”

In addition, EFRESH stated that the sales for the second quarter of the current year were significantly down when compare to the comparative period last year because, “the reduction in sales being primarily due to the effects of the Covid-19 pandemic, as well as, the company’s decision at the end of 2019 to discontinue supplying special pork cuts. We have continued with production of pork sausages and beef burgers.”

Cost of Sales for the period decreased 47% to $516.43 million relative to the $982.80 million booked the corresponding period in 2019. As such, gross profit for the period amounted to $56.77 million, a 57% decline from the $130.93 million reported in 2019. Gross loss for the quarter amounted to $5.85 million, relative to a profit of $52.26 million booked in prior quarter. Management noted, “We reduced our overheads, mainly due to the scaling back of operations at the Meat Plant. In addition to this, the hours worked by our team for the second quarter of 2020 were substantially reduced as a result of the decreased sales activity. Significantly, the company did not lay off any of our team members during this time.”

The Company reported other operating income of $3.09 million for the period, 102% more than the $1.53 million reported for the corresponding period. For the quarter other operating income closed at $2.09 million (2019: $1.34 million).

Total operating expenses decreased 27% for the six months ended June 30, 2020, to total $112.02 million compared to $153.05 million booked for the corresponding period in 2019. Of this, administrative expenses reduced to $111.52 million (2019: $152.75 million), while selling and promotion expenses advanced 67% to $501,000 (2019: $300,000).

The company reported finance cost of $15.59 million, 95% increase on the $7.99 million reported in 2019.

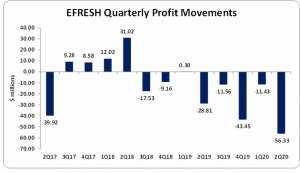

As such, the Company booked loss before taxation of $67.76 million, relative to loss before tax of $28.58 million recorded for 2019’s corresponding period. However, for the quarter loss before taxation amounted to $56.33 million versus loss before tax of $28.81 million booked in the same period last year.

No taxes were incurred for the period in review or the prior period, thus resulting in net loss for the six months closed at $67.76 million versus net loss of $28.58 million recorded for 2019. Net loss for the quarter totalled $56.33 million relative to $28.81 million recorded for the prior year’s quarter.

Consequently, loss per share (LPS) for the period amounted to $0.09 (LPS 2019: $0.04), while loss per share for the quarter totaled $0.07 (LPS 2019: $0.04). The trailing twelve months LPS is $0.16. The total amount of shares outstanding used for this calculation was 780,000,000 units. Notably, EFRESH closed the trading period on August 17, 2020 at a price of $0.67.

EFRESH noted, “Our company is currently ramping up sales in the retail sector. Sales to supermarkets and restaurants are currently trending upward compared to historical sales for these sectors.”

Balance Sheet Highlights:

As at June 30, 2020, total assets amounted to $926.30 million, 4% more than last year’s $888.08 million in 2019. This was attributed to an increase in ‘Inventories’ totalling $425.01 million (2019: $258.72 million). However, this increase was strongly tempered with by a downward movement in ‘Trade Receivables’ which amounted to $128.83 million (2019: $270.17 million).

Shareholder’s Equity decreased by 21% for six months period, totalling $472.01 million compared to the previous year’s total of $594.78 million, this resulted in a book value per share of approximately $0.61 relative to $0.76 in 2019.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.