November 14, 2022

Elite Diagnostic Limited (ELITE)

Unaudited financials for the quarter ended September 30, 2022:-

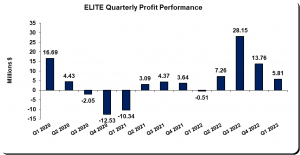

Elite Diagnostics Limited (ELITE), for the three months ended September 30, 2022 reported that revenue increased by 33% to total $187.95 million compared to $140.83 million for the same period in 2021.

Cost of sales for the period showed an increase of 6%, moving from $50.07 million to $53.19 million for the period under review. As such, gross profit amounted to $134.75 million, an increase of 48% when compared to $90.76 million recorded last year.

Elite noted, “We continue to record increased revenues in most areas which had significantly declined during the height of the Covid-19 pandemic, however unforeseen machine downtime during the period under review has negatively impacted our budgetary projections. An estimated shortfall of $25M in gross revenues was experienced due to extensive downtime which overlapped the months of August and September.”

Administrative expenses saw a jump of 40%, to total $79.76 million (2021: $56.99 million). In addition, Depreciation and Amortization amounted to $38.96 million relative to $27.27 million a year ago.

As such, profit from operations totalled $16.03 million, versus a profit of $6.50 million booked in 2021. Loss on Foreign exchange for the period totalled $2.23 million, relative to a loss of $2.18 million recorded same time in 2021. Additionally, the company’s finance cost ended at $8.01 million (2021: $4.97 million) and other income amounted to $23,296 (2021: $137,768).

Profit before tax totalled $5.81 million compared to a loss of $514,678 million recorded last year. No taxes were booked for the period.

Therefore, net profit for the period totalled $5.81 million versus a profit of $514,678 the prior financial year.

Earnings per share (EPS) for the period totalled $0.016 (2021: LPS $0.001). The twelve-month trailing EPS is $0.16. The number of shares used in our calculations amounted to 353,400,000 units. The stock last traded on November 11, 2022, at $3.72 with a corresponding P/E of 23.91 times.

ELITE noted, “during the quarter, the government instituted its most aggressive shutdown and curfew to curtail the effects of Covid-19. Although the company experienced it best ever quarterly revenue, expenses continues to increase. The overall equipment repair expenses have been reduced since solving the challenges at the St Ann location. The remaining expenses of those equipment repairs were billed in this 1st quarter.”

Furthermore, “the St Ann location continues its steady revenue growth and with the addition of the new MRI in Kingston, the company is optimistic. The installation of the new MRI system is still on schedule to be operational early 2022.

Balance Sheet at a glance:

As at September 30, 2022, total assets amounted to $1.02 billion, compared to $672.35 million for last year. This increase in total assets was mainly as a result of an increase in ‘Property, plant and equipment’ from $559.32 million in 2021 to $756.32 million as at September 2022. Management noted, “The acquisition of the Siemens MRI in 2021 has resulted in the significant variance reflected in the total assets figures reported between the comparative periods.”

Shareholders’ Equity of $484.36 million was reported (2021: $434.75 million) which resulted in a book value per share of $1.37 (2021: $1.23).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.