April 19, 2022

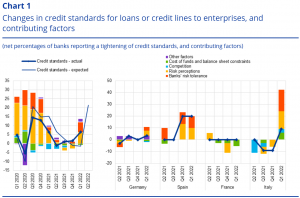

According to the April 2022 Euro-area Bank Lending Survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria, for loans or credit lines to enterprises, tightened. Regarding loans to households for house purchase, euro area banks reported a slight net tightening of credit standards, while credit standards for consumer credit and other lending to households continued to ease. Banks referred to perceptions of increased risk and decreased risk tolerance, in the context of high uncertainty, supply chain disruptions and high energy and input prices, as factors behind the net tightening of credit standards for firms. For the second quarter of 2022, banks expect a considerably stronger net tightening of credit standards for loans to firms, likely reflecting the uncertain economic impact of the war in Ukraine and the anticipation of less accommodative monetary policy. In addition, banks expect a moderate net tightening of credit standards for housing loans and for consumer credit and other lending to households.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –tightened moderately for loans to firms and loans to households for house purchase in the first quarter of 2022. For loans to firms, this was mainly due to a considerable widening of margins on riskier loans, while margins on average loans widened less. For consumer credit and other lending to households, overall terms and conditions eased slightly on account of narrower loan margins.

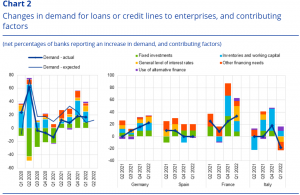

Banks reported, on balance, a continued increase in firms’ demand for loans or drawing of credit lines in the first quarter of 2022. Loan demand was driven by a strong positive impact of financing needs of firms for working capital, reflecting supply chain disruptions as well as precautionary inventories and liquidity holdings. Fixed investment continued to have a positive impact on loan demand, but less than in the previous quarter. In addition, the low general level of interest rates as well as other financing needs, including mergers and acquisitions activity and debt refinancing and restructuring, contributed positively to loan demand from firms. Demand for housing loans and for consumer credit and other lending to households increased further in net terms in the first quarter of 2022. The net increase in housing loan demand was mainly driven by the general level of interest rates. Demand for consumer credit was supported by spending on durable consumption goods and – to a lesser extent – by consumer confidence. For the second quarter of 2022, banks expect a continued net increase in firms’ loan demand, but a net decrease in the demand for housing loans and broadly unchanged demand for consumer credit.

According to the banks surveyed, access to wholesale funding deteriorated in the first quarter of 2022, reflecting tighter financial market conditions for banks. Banks reported that the ECB’s asset purchase programs and the third series of targeted longer-term refinancing operations (TLTRO III) continued to have a positive impact on their liquidity position and market financing conditions. They expect this impact to become smaller in the case of TLTROs and negative for the ECB’s asset purchase programs over the next six months. Banks also indicated that the ECB’s asset purchases programs and the negative deposit facility rate (DFR) had a negative impact on their profitability, mainly via net interest income. This effect was mitigated by the ECB’s two-tier system for remunerating excess liquidity holdings and by TLTRO III. The ECB’s asset purchases, the negative DFR and TLTRO III had a continued net easing impact on lending conditions and a positive impact on lending volumes, but generally less than previously reported. Banks expect the impact of the ECB’s asset purchase programs to turn into a net tightening for lending conditions and a mostly negative impact for loan volumes over the next six months. For the negative DFR and TLTRO III, the net easing impact on bank lending conditions and the positive impact on lending volumes are generally expected to become weaker.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem in order to improve its understanding of bank lending behavior in the euro area. The results reported in the April 2022 survey relate to changes observed in the first quarter of 2022 and expected changes in the second quarter of 2022, unless otherwise indicated. The April 2022 survey round was conducted between 7 March and 22 March 2022. A total of 151 banks were surveyed in this round, with a response rate of 100%.

Note: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Note: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.

Source: ECB

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.