FosRich Company Limited (FOSRICH) for the three months ended March 31, 2020 booked a 19% increase in revenue to total $448.82 million compared to $378.58 million for the same quarter in 2019. The Company noted, “These increases were attributed primarily to increased sales in the Industrial, Control Devices, Panels and PVC categories.”

Cost of sales for the year increased 27%, moving from $219.50 million to $278.91 million. As such, gross profit amounted to $169.91 million, an increase of 7% when compared to $159.08 million recorded for the quarter ended March 31, 2019.

Other income, for the quarter totalled $6.75 million a contraction of 26% year over year, when compared to the $9.17 million recorded for the previous year’s comparable quarter.

Administrative and other expenses rose by 28%, to total $145.65 million (2019: $114.11 million). “The increases was driven primarily by staff related costs for increases in team size, new Business Development Manager, new Operations & HR Manager, new Commercial & Project Director, increased sales commission due to improved sales performance and improvements in staff benefits; increased legal and professional fees; increased selling and marketing costs; increased insurance costs and increased computer related costs.. There were reductions in motor vehicle expenses and travelling expenses.” the Company noted.

Finance costs of $26.19 million were recorded for the period, a 23% increase when compared to $21.25 million for the corresponding period in 2019. Fosrich noted, “This increase is being driven by a new bond issue, obtained to assist with the financing of operations. This new facility was obtained at more favourable rates than the previous bank or line of credit facilities and has an extended maturity date.”

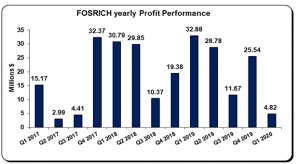

Consequently, total expenses increased by 27% which amounted to $171.84 million (2019: $135.36 million), as a result, operating profit for the quarter decreased by 85% to close at $4.82 million (2019: $32.88 million).

No taxes were incurred for the quarter, thus net profit for the three months ended March 31, 2020 totalled $4.82 million, an 85% decline compared to $32.88 million reported for first three months of 2019.

Earnings per share (EPS) for the period totalled $0.010 (2019: $0.065). The trailing twelve months earnings per share amounted to $0.14. The number of shares used in our calculations amounted to 502,275,555 units. FOSRICH’s stock price close the trading period on May 19, 2020 at $3.34.

Balance Sheet at a glance:

As at March 31, 2020, total assets amounted to $2.31 billion, up $17% or $343.81 million from the balance of $1.97 billion as at March 31, 2019. The increase in total assets was largely due to ‘Inventories’ and ‘Due from Related Parties’ which totalled $1.20 billion (2019: $949.06 million) and $282.61 million (2019: $96.59 million), respectively. The company note, “The Company continues to closely manage inventory balances and the supply-chain, with a view to ensuring that inventory balances being carried are optimised, relative to the pace of sales, the time between the orders being made and when goods become available for sale, to avoid both overstocking and stock-outs. Monitoring is both at the individual product level and by product categories. Industrial, hardware, panels and electrical lighting were the categories that reflected increases while LED, control devices, solar, wires and lighting were the inventory categories that reflected decreases.”

Shareholders’ Equity of $796.40 million was reported as at March 31, 2020 (2019: $726.23 million) which resulted in a book value per share of $1.59 (2019: $1.45).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.