Date: November 11, 2019

Fosrich Company Limited (FOSRICH) for the nine months ended September 30, 2019 turnover grew 25% year on year, to close the period at $1.19 billion compared to the $945.89 million for the same period last year. For the third quarter, the company posted an increase of 24% in revenues to close at $440.00 million relative to $353.61 million for the same quarter of 2018.

Cost of goods sold showed a 25% increase, closing the period at $671.60 million relative to $535.54 million for the same period last year. For the quarter, the company had a 13% increase in cost of goods sold to close at $240.38 million compared to $212.56 million for same quarter of 2018.

As such, gross profits for the period advanced by 25% and closed out the nine month period at $514.83 million relative to $410.36 million in the prior year’s corresponding period. Fosrich noted that, “These increases were attributed primarily to the greater availability of the products required by the market.”

Administrative and other expenses were $394.10 million, a 25% increase on the $314.10 million posted last year. According to the company, “This was driven by a combination of building out of our human resources expertise as we build capacity for the future, as well as cost associated with the 25th anniversary celebration of the company, the addition of a new Business & Relationship Manager, a new Operations & HR Manager, increased sales commission due to improved sales performance and improvements in staff benefits, increased legal and professional fees, increased selling and marketing costs, increased insurance costs and increased irrecoverable GCT.”

In addition, other income year to date increased to $21.62 million at the end of the nine months ended September 30, 2019 compared to $17.37 million booked for the similar period in 2018. According to management, this “benefitted from commissions earned on JPS streetlighting and other projects, amounting to $16.9 million.”

Fosrich incurred finance costs of $67.16 million, 58% more than the $42.62 million reported for the same period in 2018. The company highlighted, “This increase is being driven by a new bond issue, obtained to assist with the financing of operations. This new facility was obtained at more favourable rates than the previous bank or line of credit facilities.”

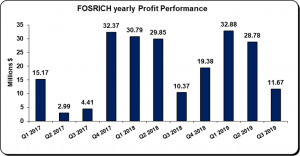

Notably, Fosrich reported a 25% increase in profit before taxation to $75.20 million relative to $71.01 million recorded in 2018. Profit before taxation for the quarter amounted to $12.60 million, up 22% from the prior year’s corresponding quarter of $10.37 million.

Fosrich recorded $1.86 million for taxes compared to nil for the same period in 2018. As such, Net Profit for the nine months ended September 2019 amounted to $73.34 million versus $71.01 million documented a year earlier. Net profit for the quarter amounted to $11.67 million relative to $10.37 million reported for the third quarter of 2018.

As a result, earning per share for the period amounted to $0.15 compared to $0.14 in 2018. EPS for the quarter amounted to $0.02 (2018: $0.02) while the twelve month trailing EPS 0.19. The number of shares used in our calculations amounted to 502,275,555.00 units. FOSICH last traded on November 08, 2019 at $4.70

Balance Sheet Highlights:

As at September 30, 2019 total assets amounted to $2.23 billion compared to $1.61 billion twelve months earlier. The growth year over year was due to a 28% increase in ‘inventories’ to $1.18 billion (2018: $919.06 million). ‘Due from related parties’ also contributed to the increase with a $253.14 million reported relative to nil the prior year.

Shareholder’s Equity for the period totaled at $766.68 million (2018: $679.98 million) resulting in a book value per share of $1.53 (2017: $1.35).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.