November 15, 2023

Fontana Limited (FTNA)

Unaudited financials for the first quarter ended September 30, 2023:

Fontana Limited (FTNA) for the first quarter ended September 30, 2023 reported a 8% increase in revenues totalling $1.78 billion compared to $1.64 billion in the corresponding three months last year. FTNA noted, “We saw increased revenues in all our locations, and growth in key metrics such as transaction counts, average spend per customer, and prescription counts.”

Cost of Sales amounted to $1.18 billion (2022: $1.05 billion), this represents an increase of 12% year over year. Consequently, gross profit increased by 2% to $603.19 million compared to $588.79 million for the first quarter ended September 30, 2022.

Administrative and Other Expenses increased by 19% to close at $504.75 million (2022: $424.10 million), while Selling and Promotion decreased by 56% from $40.18 million in 2022 to $17.59 million for the three months. As a result, Total operating expenses for the first quarter amounted to $522.34 million, a 13% increase relative to $464.28 million reported in 2022. According to management, “This is largely attributable to increased staffing to strengthen the organizational structure and ongoing staff retention efforts including the introduction of a breakfast program and departmental incentives for attaining KPIs. We also faced increased security and insurance rates, as well as set up costs for our new Portmore store including recruitment and training of the new team.”

Operating Profit for the three months amounted to $80.85 million, a 35% decrease relative to $124.51 million reported in 2022.

Other income amounted to $33.14 million (2022: $17.30 million).

Finance Costs totalled $52.61 million a 3% decrease from the corresponding period last year. (2022: $54.23 million).

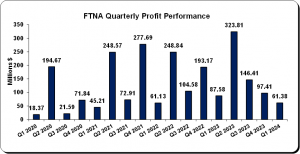

No taxes were incurred during the period. As such, net profit for the three months amounted to $61.38 million, a 30% decrease from the $87.58 million reported in 2022.

The company noted, “As we move into the second quarter, there is great anticipation about our newest addition in the Sunshine City. The response for the first few days since opening has been very encouraging, and we look forward to serving the Portmore community. We are confident that we will benefit from an increased customer base and economies of scale, as we continue to grow our brand and footprint across Jamaica”.

Consequently, Earnings Per Share for the three months amounted to $0.05 (2022: EPS: $0.07). The twelve-month trailing EPS was $0.50 and the number of shares used in these calculations was 1,249,374,825.

Notably, FTNA’s stock price closed the trading period on November 14, 2023 at a price of $10.86 with a corresponding P/E ratio of 21.57x.

Balance Sheet Highlights

The company’s assets totalled $5.24 billion (2022: $4.71 billion). The growth in total assets was mainly due to ‘Property, Plant and Equipment’ increasing 66% to close at $1.25 billion (2022: $755.57 million).

Shareholder’s equity was $2.50 billion (2022: $2.25 billion), representing a book value per share of $2.00 (2022: $1.80).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.