Brent Oil

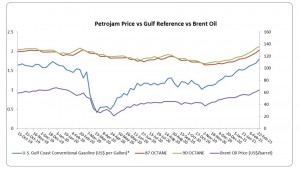

Brent oil prices decreased by 3.23% or US$2.16, as prices decreased this week relative to the prior week. Oil traded on March 04, 2021 at a price of US$64.72 per barrel relative to US$66.88 on February 25, 2021. Brent oil opened 2021 year at US$54.52 per barrel.

Petrojam prices

87 Octane prices increased this week by 2.26% (JMD$2.94). Additionally, 90 Octane increased by 2.21% or (JMD$2.94) this week. 87 Octane and 90 Octane opened the year 2021 at J$112.05 and J$114.89 respectively and now trades at J$133.06 and J$135.90 per litre respectively.

Figure 1: Petrojam, U.S. Gulf Coast Conventional Gasoline Regular, and Brent Crude Oil Price History

This Week in Petroleum

U.S. average regular gasoline and diesel prices increases

On March 01, 2021, it was noted that, “the U.S. average regular gasoline retail price increased nearly 8 cents, to $2.71 per gallon on March 1, 29 cents higher than the same time last year.” The Rocky Mountain and West Coast prices each rose nearly 13 cents to $2.57 per gallon and $3.28 per gallon, respectively, the Midwest price increased 10 cents to $2.66 per gallon, the Gulf Coast price climbed 7 cents to $2.41 per gallon, and the East Coast price increased nearly 5 cents to $2.65 per gallon.

The average diesel fuel price in the U.S. rose nearly 10 cents to $3.07 per gallon as at last week, and 22 cents higher when compared to the same period last year. The Rocky Mountain price increased nearly 13 cents to $2.98 per gallon, the Gulf Coast price rose nearly 12 cents to $2.84 per gallon, the West Coast price climbed nearly 11 cents to $3.54 per gallon, the Midwest price rose almost 10 cents to $3.04 per gallon, and the East Coast price rose more than 8 cents to $3.08 per gallon.

Inventories for Propane/propylene decreases

There was a decrease in U.S. propane/propylene stocks last week by 2.2 million barrels to 41.2 million barrels as of February 26, 2021. This was 8.7 million barrels (17.4%) less than the five-year (2016-2020) average inventory levels same time last year.

Additionally, Gulf Coast, Midwest, Rocky Mountain/West Coast, and East Coast inventories declined by 1.0 million barrels, 0.8 million barrels, 0.4 million barrels, and 0.1 million barrels, respectively.

For additional information click the link below:

https://www.eia.gov/petroleum/weekly/

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.