July 30, 2021

Grace Kennedy Limited (GK), for the six months ended June 30, 2021, recorded revenue of $63.35 billion for period (2020: $56.53 billion), a year over year increase of 12%. Revenue for the second quarter of 2021 improved 15% to $31.96 billion (2020: $27.68 billion). The biggest contributor to the group’s overall revenue for the six-month period came from the ‘Food Trading’ segment which contributed a total of $49.64 billion (2020: $44.84 billion), an increase of 11% relative to the prior year’s corresponding period. The other segments contributing to revenue are as follows:

‘Banking & Investments’ climbed 7% year over year to total $3.28 billion (2020: $3.06 billion). The Group mentioned that, “The Financial Group continued expansion of its GKONE network in Jamaica which now has 17 locations, including a new store in Clock Tower Plaza, Kingston. GKFG also unveiled its new branding in the second quarter of 2021, launching a new logo, website, and its Living A Graceful Life campaign, which reflects everyday financial optimism.”

Revenue from ‘Insurance’ amounted to $5.61 billion, a year over year increase of 23% over last year’s corresponding period of $4.55 billion. Management highlighted that, “GKGI’s motor portfolio experienced steady growth, driven by the combination of new and revamped products, such as GKI Family Connect which was launched in the second quarter of 2021. GKGI continues to expand through innovation, partner relationship management, and targeting of untapped segments. Key Insurance demonstrated improvement in performance year to date over prior year and continues to execute on its strategic objectives on the path towards sustainable profitability. Allied Insurance Brokers (AIB) exceeded core revenue over the corresponding quarter in 2020. AIB remains focused on leveraging international broker relationships, which has yielded new accounts and proven critical in maneuvering constricted markets. Canopy Insurance continues to realise growth driven by its group health product, with gross premiums for the first half of 2021 significantly exceeding the corresponding period in 2020.”

‘Money Services’ brought in $4.83 billion, 18% greater than the $4.09 billion reported in June 2020. GK noted that, “The business continues to innovate and grow its digital offerings, with Electronic Registration and Direct to Bank (D2B) services now available in three markets: Jamaica, Guyana and Trinidad. Customer registration for digital services in Jamaica in the first half of 2021 has exceeded the corresponding period of the prior year by 16%, reflecting the increased adoption of direct to bank transactions. GKMS’ bill payment business exceeded pre-tax profits over the same period of 2020. Bill Express Online continues to show strong performance in Jamaica, with a 26% increase in transactions recorded over the corresponding period of the prior year, and the service has also been introduced to the Trinidad market. GraceKennedy Remittance Services (GKRS) remains the market leader for the region and continues to record growth year over year in all territories.”

Direct and operating Expenses amounted to $59.25 billion relative to $52.96 billion booked for the previous period, indicating a 12% increase. As for the quarter, direct and operating expenses amounted to $29.49 billion, up from $25.64 billion for the second quarter of 2020. The Company booked a net impairment losses on financial assets of $229.92 million (2020: $501.99 million) and $125.44 million (2020: $254.48 million) for the six months period and second quarter, respectively.

As such, gross profit for the six months climbed 26% to $3.87 billion relative to $3.07 billion booked for the similar period of 2020. While, gross profit for the second quarter went up 31% to $2.34 billion compared to $1.79 million reported for the second quarter of 2020.

Other Income during the first six months ended June 30, 2021, rose 2% to total $1.53 billion (2020: $1.50 billion). While, other income for the quarter closed at $686.21 million (2020: $855.12 million).

Consequently, profit from operations closed the six months period at $5.40 billion (2020: $4.56 billion) and the second quarter at $3.03 billion (2020: $2.64 billion).

Interest income from non-financial services grew 24% to total $276.09 million compared to $223.46 million reported in the prior year’s corresponding period. Interest expenses from non-financial services amounted to $557.85 million versus $553.44 million a year earlier, a 1% increase. Additionally, share of results of associated companies rose by 15% amounting to $329.58 million, versus $286.93 million reported for June 2020.

As such, pre-tax profits increased 20% to approximately $5.45 billion, compared to pre-tax profit of $4.52 billion documented for the first six months of 2020. Additionally, GK incurred taxation expenses amounting to approximately $1.47 billion compared to a similar $1.47 billion in June 2020. However, the second quarter pre-tax profit closed at $2.93 billion (2020: $2.53 billion) and tax charged was $790.16 million (2020: $933.45 million).

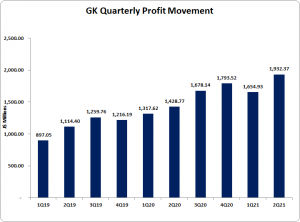

Consequently, net profit climbed 30% to $3.97 billion from $3.05 billion booked for the first six months of 2020. Net profit for the second quarter improved 34% to $2.14 billion (2020: $1.60 billion).

Net Profits attributable to shareholders amounted to $3.59 billion compared to $2.75 billion in the previous year’s corresponding period, showing a 31% increase. Net profit attributable to shareholders for the second quarter amounted to $1.93 billion, up from the $1.43 billion booked for the same quarter of 2020.

Total comprehensive income amounted to $4.90 billion relative to $3.62 billion in the previous year’s corresponding period, a 35% increase. Total comprehensive income for the second quarter amounted to $2 billion (2020: $3.23 billion).

Earnings per share for six months amounted to $3.61 (2020: $2.76), while for the second quarter, GK booked an EPS of $1.94 (2020: $1.44). GK’s trailing EPS amounted to $7.09. The number of shares used in our calculations is 995,004,356 units. GK’s stock price close the trading period on July 29, 2021 at $97.21 at a corresponding P/E of 13.70 times.

GK noted that, “GK’s Digital Transformation strategy is now fully operational and is being implemented across the Group with the support of our in-house Digital Factory team. Two financial service digital products are in the final stages of market readiness, with a six-week soft launch of the products for GK team members getting underway on July 6. Hi-Lo Food Stores, GK’s supermarket chain in Jamaica, is also preparing to launch its e-commerce website in August.”

In addition, Management stated, “GK’s acquisition of Scotia Insurance Eastern Caribbean Limited (SIECL), a licensed life insurance company operating in the Eastern Caribbean, is in its final stages. The required regulatory approvals have been received, and the deal is expected to close by the end of July. SIECL is GK’s second acquisition since the start of the year, the first being the purchase of the 876 Spring Water brand in March. GK’s M&A Unit continues to actively pursue several prospects which it has in the pipeline.”

Balance Sheet Highlights:

As at June 30, 2021, the company’s assets totalled $182.28 billion versus $163.63 billion booked a year ago. The improvement resulted in part from a growth in ‘Cash and Deposits’ and ‘Investment securities’ which closed at $27.75 billion (2020: $17.71 billion) and $36.71 billion (2020: $31.83 billion), respectively.

Shareholders’ equity amounted to $63.51 billion which compares to shareholder’s equity of $54.92 billion as at June 30, 2020. As a result, book value per share amounted to $63.83 (2020: $55.19).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.