April 1, 2020

Government Operations Results for February 2020

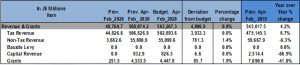

For the period of April 2019 to February 2020, the GOJ reported Total Revenues & Grants of $568.07 billion, $4.81 billion more than the Government’s projection. Furthermore, year over year, this represents an increase of approximately 4.2% relative to the $545.02 billion recorded for the corresponding period in 2019. ‘Tax Revenue’, ‘Non-Tax Revenue’, ‘Capital Revenues’ and ‘Grants’ all outperformed projections during the review period. ‘Tax Revenue’ amounted to $506.83 billion; $3.93 billion more than budgeted. Likewise, ‘Non-Tax Revenue’ closed at $55.88 billion, $781.30 million over the expected amount. ‘Capital Revenue’ of $832.9 million was reported; $6.60 million more than budgeted. Lastly, ‘Grants’ totaled $4.53 billion, $85.7 million or 1.9% more than budgeted. Notably, no provisional amount was booked for ‘Bauxite Levy’ for the previous and review period.

Expenditures

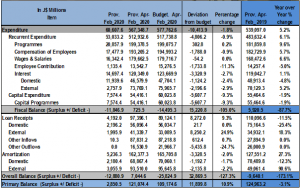

Total Expenditure for the period April 2019 to February 2020 amounted to $567.35 billion, $10.41 billion or 1.8% less than the budgeted amount of $577.76 billion. Recurrent expenditure which totaled $512.93 billion, accounted for 90.41% of overall expenditures, which is $4.81 billion less than what was budgeted. Of the recurrent expenditure categories for the review period, all categories except ‘Programmes’ which closed at to $199.38 billion, $302.80 million greater than the budgeted amount, were below the projected amount. As such, ‘Compensation of Employees’ amounted to $193.21 billion which was $1.79 billion or 0.9% less than projected. Similarly, ‘Wages and Salaries’ totaled $179.66 billion, $54.20 million below the budgeted amount. In addition, ‘Employee Contribution’ totaled $13.54 billion, 11.3% less than the budgeted amount of $15.28 billion.

As a result of the decrease in Expenditures for the period April 2019 to February 2020, the ‘Fiscal Surplus’ was $725.50 million, relative to a projected deficit of $14.50 billion. Additionally, the primary balance for the period amounted to $121.07 billion, 10.9% more than budgeted.

Revised Budget

Second Supplementary Estimates

The House of Representatives approved the Second Supplementary Estimates on February 4, 2020 subsequent to the First Supplementary Estimates released on October 31st, 2019.

“The Second Supplementary Estimates FY 2018/2019 was tabled in Parliament on January 21, 2020 and reflected total Central Government expenditure of $859,071.6mn, an increase of $7,966.7mn above the First Supplementary Estimates. The increase in expenditure is entirely on the recurrent side, with Programmes increasing by $5,815.5mn and Compensation by $2,151.2mn. Higher than programmed revenue yields supported the increased expenditure.”

Revised Expenditures Estimates

For Financial Year 2019/20, further adjustments made in the Second Supplementary Estimates to the Estimates of Expenditure were as a result of:

- The increase over the First Supplementary budget was fully reflected in Recurrent Programmes, as such pension costs are expected to be less by $2,200.0mn based on current assessments to end-March which anticipates payment on all fully processed pension files. This reduction, coupled with higher revenue flows, has created room to reallocate as well as accommodate additional expenditure.

Included in the additional expenditure are the following:

- $1,000.0mn of arrears due to the NHT;

- $408.8mn in electricity arrears owed by educational institutions;

- $1,490.0mn in PAYE and Education Tax arrears owed by the JUTC;

- $600.0mn in additional subvention to the University of Technology (UTECH);

- $600.0mn in additional subvention to the University of the West Indies (UWI).

- While the provision for Capital Expenditure remains unchanged relative to the First Supplementary Budget, based on the under-performance of some projects over the first three quarters of the fiscal year, there has been some reallocation within the overall capital envelope.

Of note, some projects under the Works portfolio of the MEGJC that are able to execute above the programmed amounts under the First Supplementary Estimate have been provided with additional allocations:

- MIDP – $2,365.0mn to be spent for land acquisition and $1,035.0mn in respect of NWC ancillary works;

- SCHIP – $1,301.0mn to be spent to finalize designs and to commence civil/road works; and

- Road Rehabilitation Project II – $453.0mn.

Revised Revenues Estimates

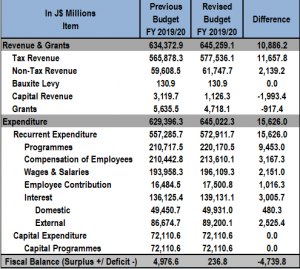

- Revenue and Grants for FY 2019/20 are estimated to be 2.6% greater than FY 2018/19 at $645,259.1mn, or 29.9% of GDP. This is 1.1% more than estimated in the First Supplementary Budget.

- Tax Revenue is estimated at $577,536.1mn, an increase of 6.4% over the FY 2018/19 outturn, despite the removal of a variety of distortionary taxes with an estimated revenue loss of $14,000.0mn (0.7% of GDP). The Government noted that, “positive adjustments in macroeconomic variables alongside improved compliance rates and enhanced efficiency at the revenue collection agencies are expected to boost collections.”

The FY 2019/20 budget also includes Other Outflows towards:

- BOJ losses/recapitalization

- PetroCaribe obligations to South Jamaica Power Company Limited,

- Development Bank of Jamaica to finance on-lending to the productive sector and Petrojam; and

- A bridge loan to NROCC to facilitate transactions related to the TransJamaican Highway transaction

The Government highlighted that, “Other Inflows, including flows from the PCDF, have more than tripled year-over-year reflecting the integration of the Fund into the Central Government. As a result of the increase in Other Inflows, estimated loan receipts for FY 2019/20 are lower than that of last fiscal year. Amortization payments are estimated at 34.2% over the last fiscal year partly on account of higher year-over-year maturities, with some contribution from depreciation of the Jamaica dollar.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.