Date: November 02, 2018

Government Operations Results for September 2018

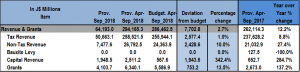

For the period of April 2018 to September 2018, the GOJ reported Total Revenues & Grants of $294.17 billion, $7.70 billion more than the Government’s projection. Year over year, this represents an increase of approximately 12.2% relative to the $262.11 billion recorded for the corresponding period in 2017. ‘Tax Revenue’, ‘Non-Tax Revenues’, ‘Capital Revenue’ as well as ‘Grants’ outperformed projections during the review period. ‘Tax Revenue’ amounted to $258.52 billion, $2.58 billion more than budgeted, while ‘Non-Tax Revenue’ of $26.79 billion was reported; $2.43 billion more than budgeted. ‘Grants’ overperformed budget by $753.2 million, amounting to $6.34 billion during the review period, while ‘Capital Revenue’ totalled $2.51 billion, $1.94 billion or 342.4% more than budgeted. Notably, no provisional amount was booked for ‘Bauxite Levy’ for the review period.

Expenditures

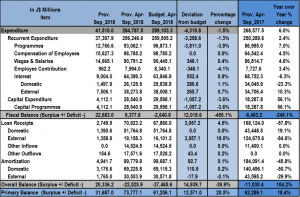

Total Expenditure for the period April 2018 to September 2018 amounted to $284.79 billion, $4.32 billion or 1.5% less than the budgeted $289.10 billion. Recurrent expenditure which totalled $256.25 billion, accounted for 89.98% of overall expenditures. Relative to projections, recurrent expenditure was $3.26 billion (1.3%) less than budgeted. ‘Programmes’ which amounted to $93.06 billion was $3.81 billion or 3.9% less than projected, while ‘Employee Contribution’ which amounted to $7.99 billion for the period was under budget by 4.1% relative to the budgeted $8.34 billion. ‘Compensation of Employees’ amounted to $98.79 billion, the same amount as was projected. However, ‘Wages & Salaries’ amounted to $90.79 billion and was $346.1 million or 0.4% more than projected.

As a result of the increase in Expenditures for the period April 2018- September 2018, the ‘Fiscal Surplus’ was $9.38 billion, relative to a projected deficit of $2.64 billion. Additionally, the primary balance for the period amounted to $73.78 billion, 20.5% more than budgeted.

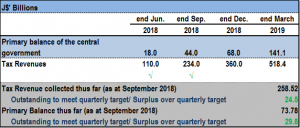

As part of the Memorandum of Economic and Financial Policies (MEFP), the GOJ estimates that the primary balance, as a performance criterion, should amount to $141.1 billion by the end of the 2018/2019 fiscal year. For the September quarter, a primary balance of $44.0 billion was estimated. As at the end of September 2018, this amounted to $73.78 billion. Tax Revenue was expected to total an estimated $234.0 billion by the end of the September quarter. The reported tax revenue for the end of September 2018 was $258.52 billion.

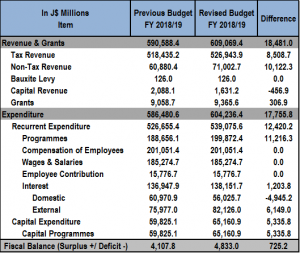

Revised Budget

Deviating Occurrences Leading to Supplementary Budget

YTD, the government for the most part has outperformed its targeted revenue while keeping most expenditure line items below budget with the exception of Capital expenditures. Capital expenditure during the first quarter of the fiscal year (Apr-Jun 2018), was “higher than budget for the period by approximately 5%.” This according to the government is the first in nearly a decade.

The main capital project performing above estimate is “the Major Infrastructure Development Programme (MIDP) under which major improvements are being implemented along the Mandela Highway, Constant Spring Road and Hagley Park Road.” It was further noted that “Over the fiscal year to date a number of critical expenditure pressures have emerged that have necessitated a revision of the FY 2018/19 Budget resulting in net additional expenditure of $17.4 billion.”

Although Expenditure was $4.32 billion below target, the significant factors that led to a supplementary budget were:

- Non-Debt Expenditure of $466.1 billion

- Some Major Items:

- Street Lighting Arrears and Current Payments – $7.14 billion

- JUTC – $2.505 billion

- Major Infrastructure Development Programme – $7.335 billion

- Proposed Increase in Travel Allowances/Mileage to Travelling Officers – $2.423 billion

- Some Major Items:

Non-Debt Expenditure is expected to rise by $16.6 billion due to the ‘Street Lighting Arrears and Current Payments’ due to Jamaica Public Service (JPS) by the Local Government. This increasing arrears for street lighting have translated into significant and growing areas due to Petrojam by the JPS. Additionally, the non-payment to Petrojam is impacting the Company’s capability to pay its tax obligations and other expenses which forces the Company to obtain additional financing to facilitate its operations.

With regards to the Major Infrastructure Development Programme (MIDP), adjustment in the provision to align expenditure with the increased pace of execution; that is the major improvements that are being undertaken in the Kingston Metropolitan Area that needs to be completed within the shortest possible time, led to $7.34 billion being accommodated in the Supplementary Estimates.

- Debt Service of $289.9 billion

Debt service is estimated to increase to $289.9 billion. As indicated by Dr. Nigel Clarke, “Debt Service is estimated to increase due to external payments and arises as a result of the increase in the applicable exchange rate of the Jamaica Dollar to the United States Dollar. The negative impact of the exchange rate is to some extent offset by the impact of lower domestic Treasury Bill rates.”

- Below the Line Provision of $35.2 billion to address Bank of Jamaica recapitalization, the purchase of Petrojam shares and the loan to Port Authority of Jamaica in respect of the Business Process Outsourcing facilities.

The First Supplementary Estimates is expected to be financed as follows:

- Reallocation of Resources within the Original Approved Budget:

- $2.5 billion – the lower than estimated take-up under the special early retirement programme (SERP), has resulted in projected savings of approximately $2.5 billion from the $4.979 billion allocated for the programme;

- $1.2 billion – Jamaica Civil Aviation Authority’s Surrenderable Balances being utilized to offset current year expenditure; this will be reflected in the Supplementary estimates as Appropriations-inAid thereby reducing the warranted expenditure;

- $2.67 billion – from Capital Projects, mainly the Southern Coastal Highway Improvement Programme ($1.4 billion) due to the delay in commencing implementation; and the slower than programmed execution of other projects;

- The PetroCaribe Development Fund

- US$55 million (approximately) in additional special financial distribution thereby bringing total special financial distribution from the PCDF to US$156 million during FY 2018/19;

- Revenue Flows

- The remaining $8.5 billion is expected to be financed from higher revenue flows.

According to the government, “The medium-term path outlined for the fiscal operations is expected to generate sustainability of the fiscal operations, thereby placing the country firmly on the path to achieve developed country status.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.