Date: November 04, 2019

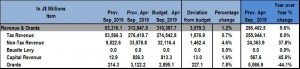

For the period of April to September 2019, the GOJ reported Total Revenues & Grants of $313.95 billion, $3.58 billion more than the Government’s projection. Furthermore, year over year, this represents an increase of approximately 9.6% relative to the $286.46 billion recorded for the corresponding period in 2018. ‘Tax Revenue’, ‘Non-Tax Revenue’, ‘Grants’ and ‘Capital Revenues’ outperformed projections during the review period. ‘Tax Revenue’ amounted to $276.42 billion, $1.88 billion more than budgeted while ‘Non-Tax Revenue’ of $33.58 billion was reported; $1.46 billion more than budgeted. ‘Grants’ outperformed the budget by $227.1 million, amounting to $3.12 billion during the review period. Whereas, ‘Capital Revenues totalled $826.3 million, $13 million or 1.6% more than budgeted. Notably, no provisional amount was booked for ‘Bauxite Levy’ for the review period.

Expenditures

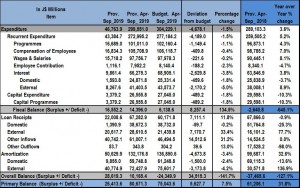

Total Expenditure for the period April to September 2019 amounted to $299.55 billion, $4.68 billion or 1.5% less than the budgeted $304.23 billion. Recurrent expenditure which totalled $272.99 billion, accounted for 91.13% of overall expenditures. Relative to projections, recurrent expenditure was $4.19 billion (1.5%) less than budgeted. Of the recurrent expenditure categories for the review period, all categories were below the budgeted amount. ‘Programmes’ which amounted to $101.01 billion, was $1.15 billion or 1.1% less than projected. Wages & Salaries’ amounted to $97.76 billion and was $221.60 million or 0.2% less than projected. Whereas, ‘Compensation of Employees’ which amounted to $105.71 billion was $409.80 million or 0.4% less than projected. In addition, ‘Employee Contribution’ totalled $7.95 billion, 2.3% less than the budgeted amount of $8.14 billion.

As a result of the decrease in Expenditures for the period April to September 2019, the ‘Fiscal Surplus’ was $14.40 billion, relative to a projected surplus of $6.14 billion. Additionally, the primary balance for the period amounted to $80.67 billion, 7.5% more than budgeted.

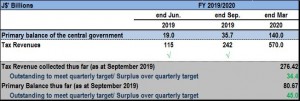

As part of the Memorandum of Economic and Financial Policies (MEFP), the GOJ estimates that the primary balance, as a performance criterion, should amount to $140.01 billion by the end of the 2019/2020 fiscal year. Up to the September quarter, a primary balance of $35.70 billion is estimated. As at the end of September 2019, this amounted to $80.67 billion. Tax Revenue is expected to total an estimated $242 billion by the end of the September quarter. The reported tax revenue for the end of September 2019 was $276.42 billion.

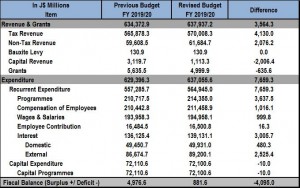

Revised Budget

Deviating Occurrences Leading to Supplementary Budget

YTD, the government for the most part has outperformed its targeted revenue while keeping most expenditure line items below budget.

However, the emergence of additional expenditure requirements since the approval of the budget in March 2019 has necessitated the formulation of a supplementary budget. According to the Ministry of Finance, “The First Supplementary Budget for FY 2019/20 is developed against the backdrop of continued positive performance in total revenue, evidenced by the better-than-budgeted Tax Revenue collections for the April to July period of the fiscal year.”

Although Expenditure was $4.68 billion below target, the significant factors that led to a supplementary budget were:

- The additional non-debt recurrent expenditure being facilitated relates to allocations towards, inter alia:

- Addressing critical payments to facilitate the continued smooth operations of the Tax authorities;

- Facilitating the refund of customs charges which were misclassified as GCT and paid into the Consolidated Fund;

- Pensions related expenditure, including the additional cost of implementing the rate increase to the health scheme for pensioners; and

- Addressing the shortfall in the 2019/20 allocation for the Caribbean Catastrophe Risk Insurance Facility (CCRIF) premium payment.

- Major Infrastructure Development Programme (MIDP) of $5 billion

With regards to the Major Infrastructure Development Programme (MIDP), another $5 billion has been allocated to fund, among other things, corrective work for residents whose homes were impacted by the roadworks in St James and Westmoreland.

The MIDP, which includes the upgrading and expansion of major roadways across the island, is being funded through a loan from the Exim Bank of China and the Jamaican Government.

- Some additional items:

- Jamaica Water Resources Development Master Plan – $655 million

- $550-million funding for the Montego Bay Closed Harbour Beach Park – $164 million added

- Great Climate Readiness Programme – $60 million added.

- Debt Service of $45.50 billion

Debt service is estimated to increase to $45.50 billion. As indicated by the Ministry of Finance, “this comprises $40,205.0mn in amortization and $5,295.4mn in interest payments. The increase in Public Debt Service reflects the impact of recent liability management activities.”

The First Supplementary Estimates is expected to be financed as follows:

- Reallocation of Resources within the Original Approved Budget

- Additional expenditure is expected to be financed through the increased space afforded by the positive revenue performance as well as through the adjustment of the targeted primary balance arising from the lower growth forecast

According to the Government, “The medium-term fiscal profile reflects updated projections that are consistent with the adjustments to the medium-term macroeconomic outlook as well as with the fiscal policy priorities of the GOJ.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.